One of the biggest issues I’ve had with the domain industry is unrealistic expectations. There are way too many articles, books, and videos out there making it looks like you can quit your job, become a domain investor, and then poof – you’re rich.

The reality is, it’s hard to make money with domain names and most people are only going to afford to be able to do it part-time vs. quitting their days jobs. Also most people lose money their first year (or two) trying their hand at the domain game.

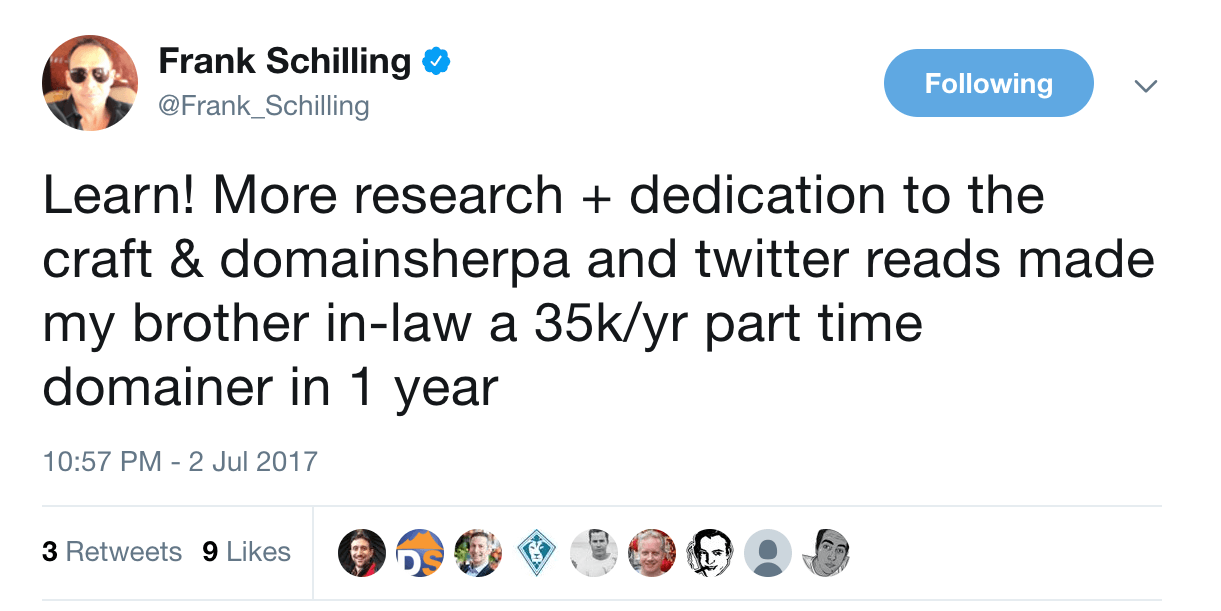

That being said, there are more realistic expectations to set if you really apply yourself part-time and I think Frank Schilling’s brother-in-law is a great example – he made $35k in his first year.

While I still think most people who get into domain investing should set even lower expectations for their first year, and maybe even expect to lose money while learning, I think this sets a much more realistic bar for what you can do if you really apply yourself for a year part-time.

The one question I don’t know the answer to is if this is $35k in revenue or $35k in profit so if Frank is reading this that would be an interesting datapoint to know. Either way I think this is a great example of something much more realistic for new domain investors rather than thinking you can quick your day job and make a six-figure income right out of the gate.

What do you think? Is $35k a reasonable expectation for someone’s first year investing in domain names?