I read an interesting article this week on DomainInvesting.com with Elliot’s thought on investing in hundreds of domain names vs. thousands of names. I think most people know Elliot, and know he has some very solid names – he’s focused on quality over quantity.

However that’s just one of two paths, other investors like Mike Mann have large portfolios and make (and report) the huge volume of sales they end up making. It makes sense right? More domains, more sales, but each of these models requires a different strategy and focus.

Right now Elliot’s portfolio has about 500 domains in it but there was a time when he thought about building up a portfolio of 25,000+ names:

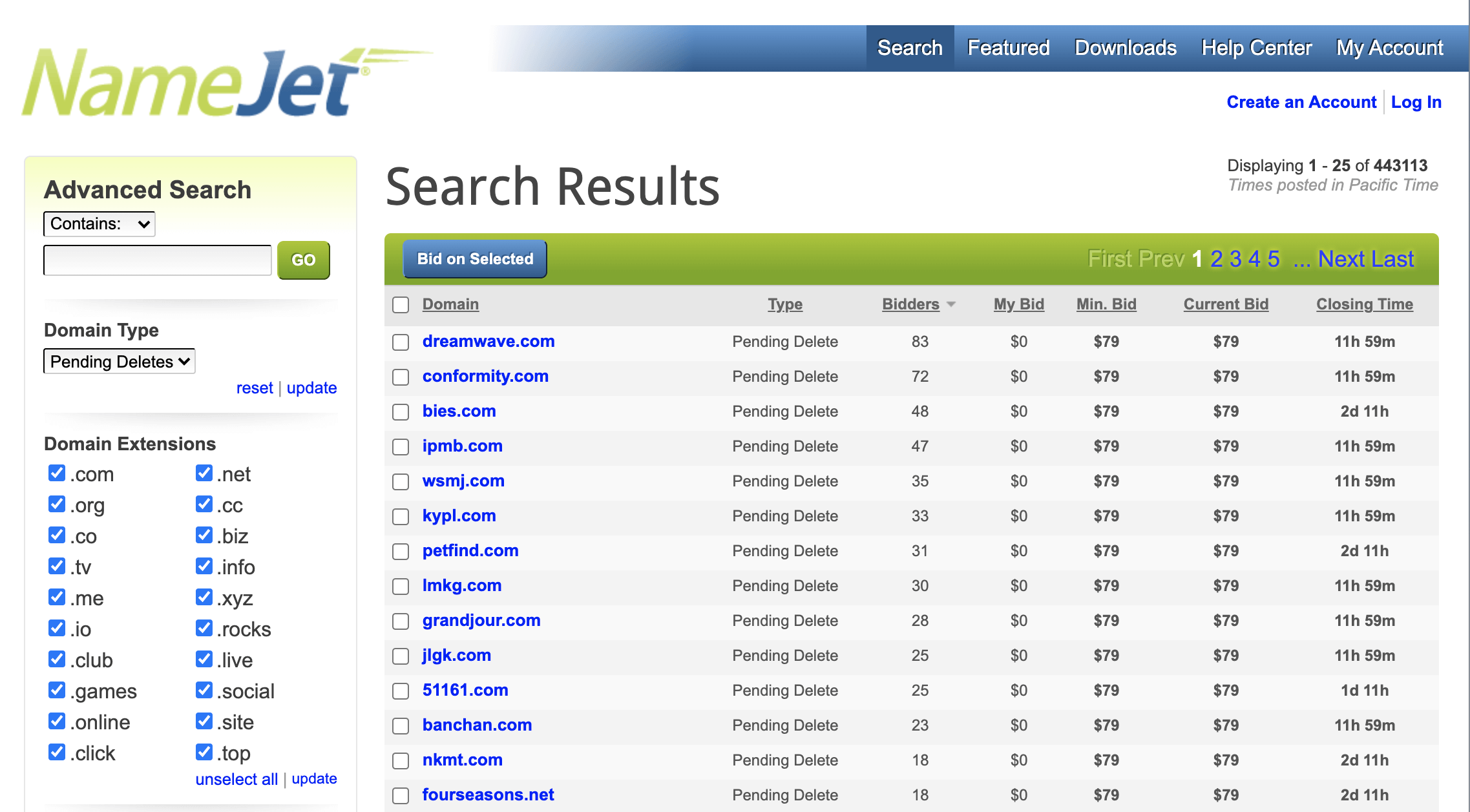

“Buying thousands of domain names proved to be much more difficult than the model that has worked well for 10+ years. To alter my strategy, I would need to be somewhat less discriminating about the domain name I purchase. I would need to be more active in auctions and target far more domain names. I found that this was a major challenge as many names I thought I could buy for under $100 were selling for much more at auction. It was taking a great deal of time to find good values. At the rate I was going, bidding on auctions was not going to get me to 25k domain names very quickly and it would be very expensive.” (Elliot Silver)

Like Elliot, I also have a portfolio of around 500 domains, and have thought about what it would be like to have thousands or tens of thousands. I have very similar feelings to Elliot and really just acknowledge that it’s a whole different game.

What do you think? Are you going for a thousand or ten-thousand name portfolio or focusing on a smaller portfolio with bigger names? Do you think one path is better than another?

Comment and let your voice be heard!