When I bought my first ape the week the project launched I didn’t think much about traits and rarity, instead I was focused on something that would make an awesome profile picture. Then, as time went on and I continued to buy more apes, I started to spend a lot more time looking at traits, and rarity, and really started to pay attention to trends, which change quite a bit over time.

Fast-forward to today and I’ve found quite a few friends coming to me for advice on buying their first ape. Of course, things have changed a lot since the early days. First things first, a floor ape isn’t 0.35ETH, and some traits have really taken off that weren’t on anyone’s radar back in the olden days, i.e. three months ago.

As I’ve found more and more friends coming to me lately trying to find a solid investment-grade ape, and had the same conversation at least fives times now I thought, why not put together a little blog post about it. I’ll keep this short and sweet so let’s jam.

First – don’t just look at overall rarity

You probably already know about rarity.tools, if you don’t, that’s where you should probably be doing most of your research when it comes to traits and rarity. The biggest gotcha when it comes to picking an investment-grade ape IMO is focusing on overall rarity and not looking at the overall traits an ape has.

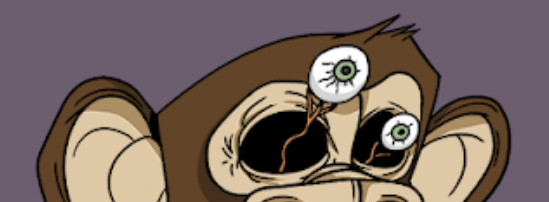

Here’s an example. There’s a trait that’s relatively rare for eyes called “crazy” that looks like this:

While only 407 out of 10,000 apes have this trait, it tends to track the floor, i.e. it doesn’t add to the price or investment value of the ape. Some people think this trait can actually hurt value because it just doesn’t look as good in a profile pict or blown up and framed on your wall. The same goes for coin eyes:

Once again, reasonably rare with only 479 out of 10,000 apes sharing this trait, but just not a great looking trait and it tends to track near the floor, but above crazy eyes. If you just look at overall rarity and find something that has an overall rarity of say 2,000 – 3,000, having a trait that makes it less attractive as a PFP (profile pict) can hurt the value. Remember, part of the value in Bored Apes is using it as a profile picture and being able to hang it on your wall as the awesome art that it is.

The reality is, while I love all apes, all 10,000 apes aren’t quite the same when it comes to making great PFPs or hanging on your wall (sorry but it’s true 🤷♂️ ) so keep that in mind when you’re picking an ape as it definitely impacts long-term investment value.

Second – learn what traits are popular now

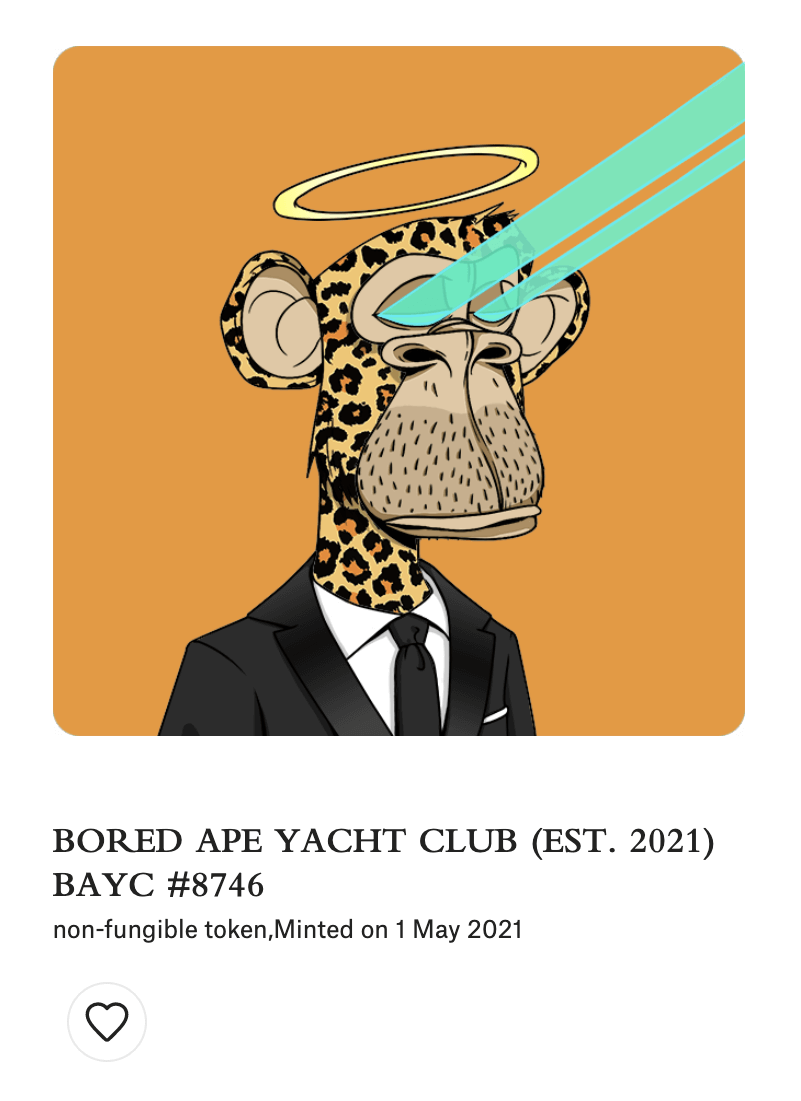

Some specific traits will pop for one reason or another. A good recent example is the Christie’s Auction that features this beautiful ape:

The suit he’s wearing, that specific color of laser eyes, the angel halo, and of course the ever-popular cheetah fur are all decent ones to bet on. Next week Brad Pitt could buy an ape and could make one trait that hasn’t been as popular in the past rocket in value, trait value can change so pay attention to the floor prices on specific traits and how they change.

Third – try to find an ape with three or more rare/rare(ish) traits

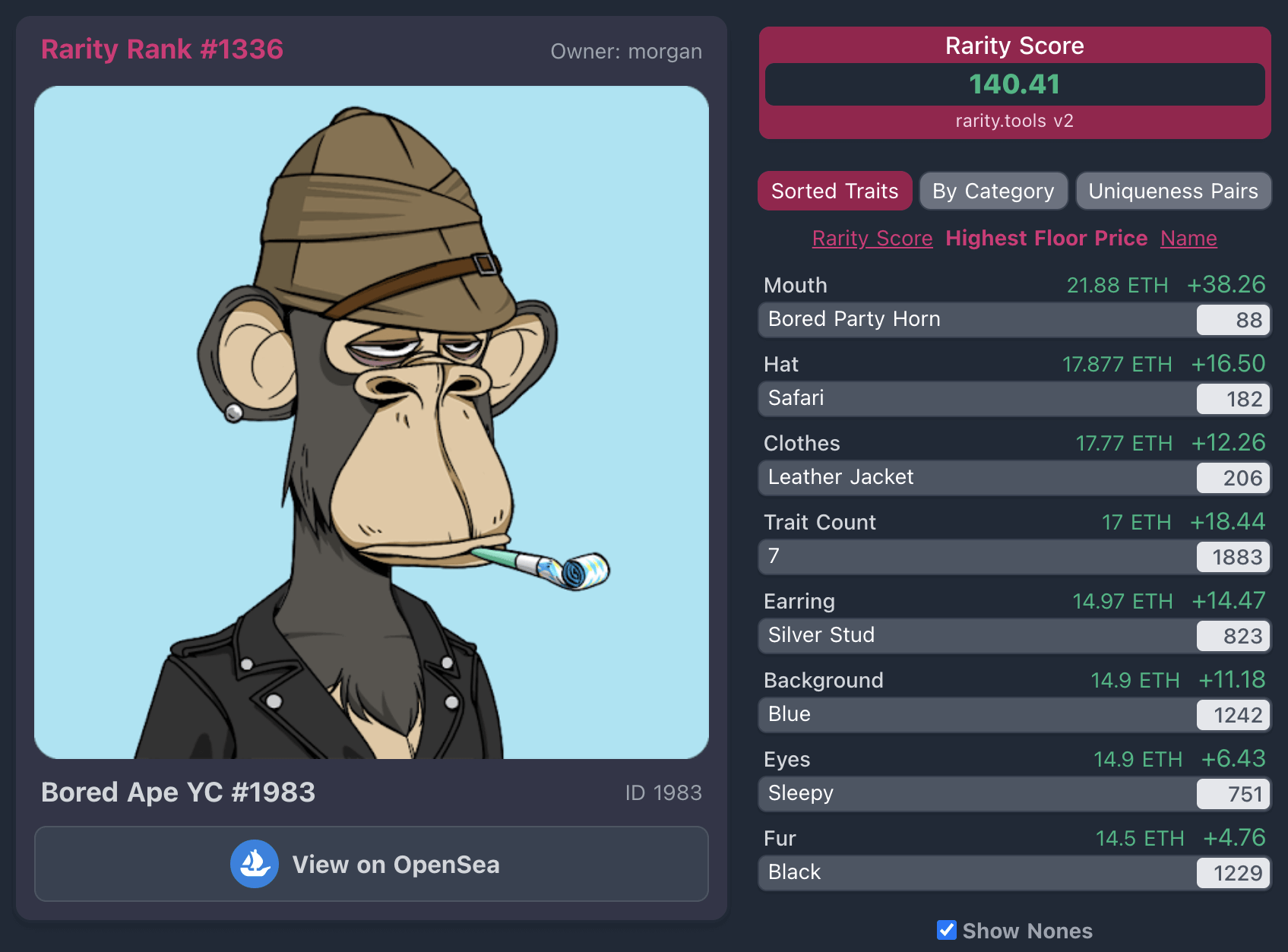

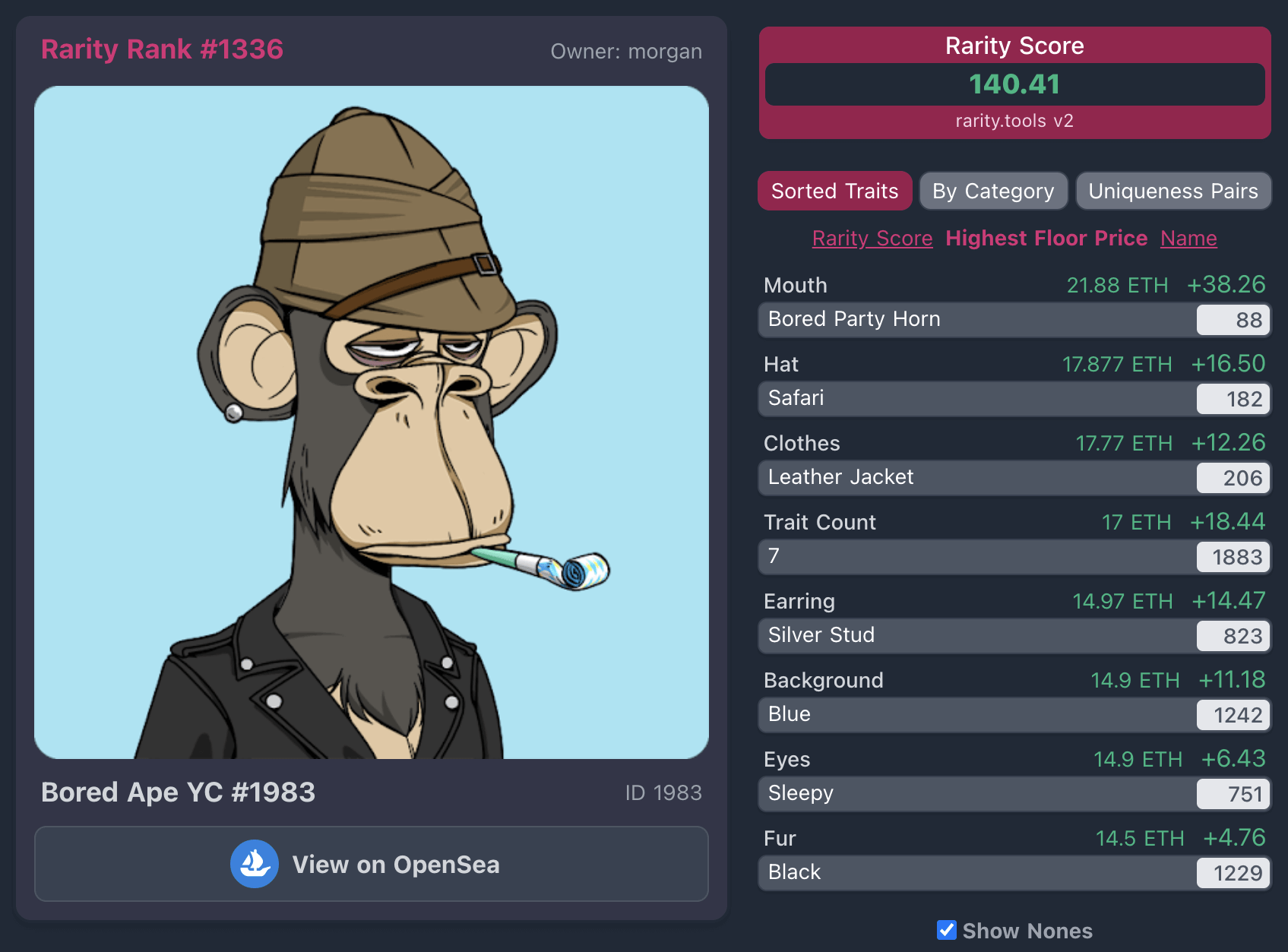

This might just be a me thing, but it’s something I look at when buying apes and something I’ve recommended to friends. While it can be easy to be drawn in by one single rare trait, if you can find an ape with three rare, or rare(ish) traits, you’re essentially giving yourself a better chance of seeing stronger growth because one of those three rare traits could pop and your ape would go with it. Here’s an example from my portfolio:

The Bored Party Horn is a legit rare trait with only 88 apes having it. But I also have the Safari Hat and Leather Jacket that are rare(ish) and could see rising floors that would bring the overall value of this ape up. While having a part horn on it’s own is great, if you can couple it with two other rare(ish) traits, I think it gives you a better shot at seeing stronger investment growth over time.

Okay, while I could keep writing, and writing, and writing, about this topic, I’m going to leave it there for now. If you liked this article and would like me to go deeper, ask for a Part Two in the comment section below and I’ll make it happen. Of course, if you think this article totally sucked and my advice is garbage, you can share that too, comments are open – comment and let your voice be heard!

Thanks for reading, ape strong together ❤️ 🦍

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. I am an investor in Bored Ape Yacht Club and Bored Ape Kennel Club.