Okay, before I get into the topic of this post I thought I’d mention my lucky number since it directly relates to this in a strange way. When I first started college one of my friends mentioned that the number 23 had always been lucky for him and 323 had been even luckier. My first response was, well numbers can’t really be lucky, if you start paying attention to a number then sure, you’re likely to see it more and think it’s lucky.

Then I started finding 23 and 323 popping up more and more in my life, in strange ways. They became my lucky numbers and while I still mostly believe it’s random and that sure, I just notice things related to the number 23 or 323, I’ve still found it fascinating to see how these numbers continue to come up over time.

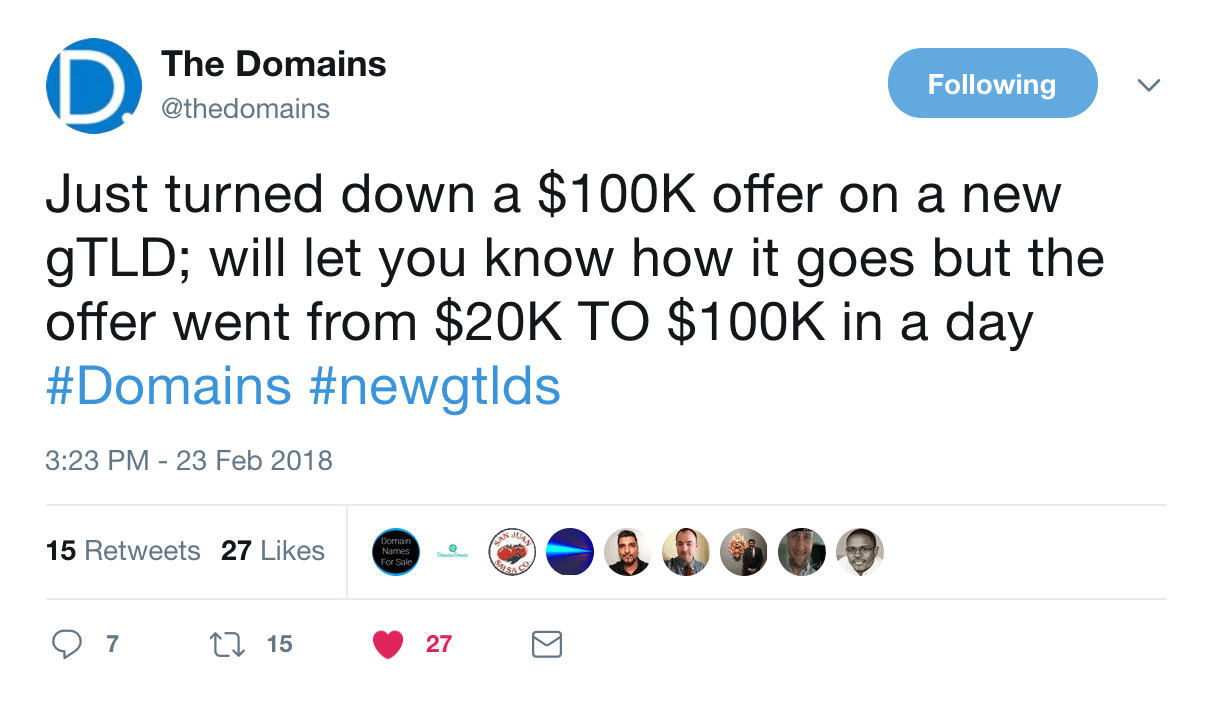

Thoroughly confused about what the heck this has to do with an $100,000 offer on a new gTLD? Let me explain. Yesterday, veteran domain name investor and publisher of the popular blog TheDomains, Michael Berkens, shared a tweet about a six-figure offer he received on one of the new gTLD domain names that he owns:

This tweet caught my eye since I haven’t been very bullish on new gTLDs so it’s always interesting to see someone like Michael tweeting about what sounds like a very solid offer (although not high enough to buy the name) on one of the new gTLD domain names that he owns. Also, and no there’s no way for me to game this or make it up…the tweet happened to take place on Feb 23rd, at 3:23PM.

Okay, that’s probably completely random, but it was too interesting not to bring up given my history with the number 23 and 323. Now back to Michael’s tweet.

A $20k starting offer is always a nice thing to get – going from $20k to $100k in one day is also a massive jump. While I don’t think this means all of us should suddenly start buying up new gTLDs, I do think it’s an interesting datapoint and sign of end-user interest in non .COMs.

My guess is the domain Michael is referring to would probably cost seven figures if it was a .COM, it’s likely a very premium new gTLD, and to an end user that doesn’t have $1M+ to buy the .COM, in this case the new gTLD was a very viable alternative.

Consumer habit changes take a long time…remember cellphones first went on sale in the US in 1983 and the first laptop came out in 1981. Everyone has cellphones and laptops now but ten years after each of these was introduced…very few people had them. I mean come on – did you have a cellphone in 1993?

I digress. My point here is that new gTLDs are only a few years old. If they do take off…it’s probably going to take a decade or more to see if it happens. I can’t help but find it interesting that in the very early days of new gTLDs, there are people out there making $20,000 offers and increasing them by 5x to $100,000 in a day – someone clearly sees real value there.

Of course, this is just one datapoint and ten years from now every new gTLD could have failed and anyone who invested in them could be out of luck. Only time will tell but I appreciate Michael sharing this, and of course now I’m dying to know what the domain name was. Oh and yes it’s still is a bit eerie to me that this was posted at 3:23PM on February 23rd…

What do you think? Is this an example of the future promise new gTLDs will see in the future, or just a random blip in the radar? I don’t currently invest in new gTLDs and this isn’t enough to convince me to change my buying habits, but it does get my gears turning.

What do you think? Comment and let your voice be heard!