I’ve been writing more and more about UDRPs lately, along with the abuse that I think we can all see happening right in front of us. In many cases I see a simple scenario where someone does’t want to spend the money to buy their exact match domain, so they use the UDRP process to get it for pennies on the dollar.

Five and six-figure domains are definite targets and three character .COMs seem to be getting their fair share of the attention. Yesterday DomainInvesting.com shared details about a new UDRP against AEX.com by a company that currently has their site on AEX.nl.

The domain name was sold to the current owner by Anything.com who does have a history of selling domain names for big bucks so it’s likely that the current owner paid a pretty penny for this domain.

According to the DomainTools Whois History tool, the AEX.com domain name had been owned by Anything.com as recently as May of 2017. Knowing a bit about Anything.com and its domain portfolio as well as some of its publicly known sales, it must have sold for a substantial amount of money. Regardless of its provenance, AEX.com is a valuable domain name. (Source – DomainInvesting.com)

Given that CPX.com sold for $44,700 two weeks ago it’s safe to say that AEX.com would likely sell for $50,000+ and could easily sell for six-figures given the wide price range that three character .COMs sell for.

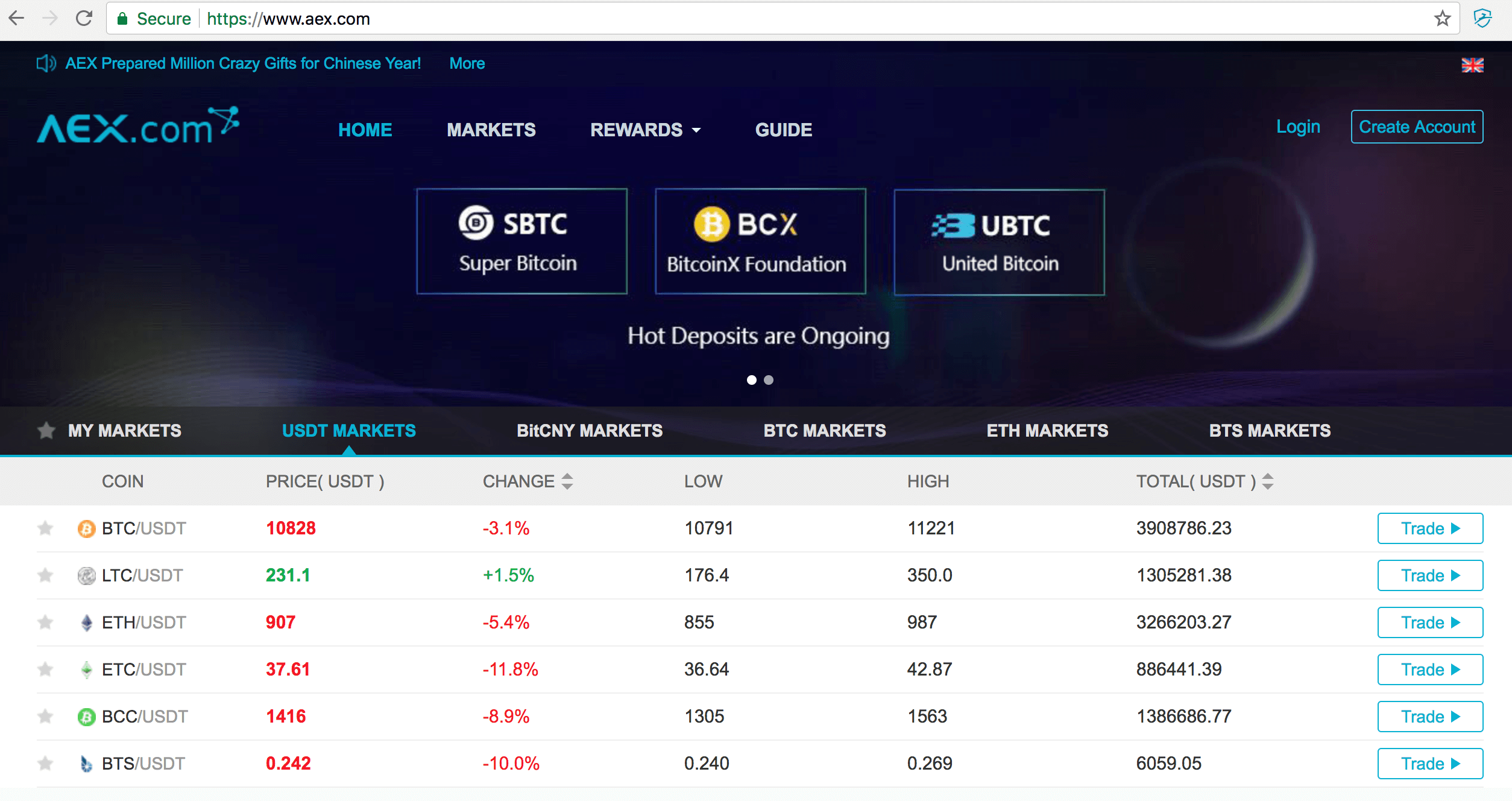

In this case, the current owner of AEX.com isn’t a domain investor, instead it’s an end-user that bought the domain from Anything.com to use for a cryptocurrency site:

I wrote an article early this month asking the question – are six-figure domains a risky investment? I don’t know how much the current owner paid for AEX.com but like I speculated above, it was probably north of $50,000 and sure, there are probably people out there that would pay six-figures for it.

This UDRP is another great example of the risk domain owners face (investor or not) when they buy high-value domain names. I’ve heard some startup founders say, “well I don’t have to worry since I’m not a domain squatter, this is my one and only domain for my business.”

It doesn’t matter – whether you’re buying the domain as an investment, or as the primary domain for your site, short, valuable domain names like this are prime UDRP targets. Given that UDRPs are still a fairly arbitrary process that often comes down to personal opinion more than legal right this makes domains like AEX.com a bit scary to own, no matter what your plans are for it.

For me as a domain investor, most of the domains I buy are under $10,000 – heck most are under $5,000 and I sell domains in the $2,500 – $7,500 range on average. I have thought about one day buying a domain for $25,000 – $50,000 that could sell for six-figures, the opportunities are definitely out there.

But for now, I don’t think it’s worth the risk. I’d rather buy 20 domains for $5,000 each or 50 domains for $1,000 each. Less risk and I think in many ways the same or even better/faster ROI. I also think that’s why as an investor, I’d rather deploy capital in that range into things like the stock market and real estate that carry less risk.

I’m a big fan of diversification, and domains are still the primary place I invest my money, but I’ll be staying away from three character .COMs and other short, valuable domains that are a target for the current, broken, UDRP system.

What do you think? Am I being overly dramatic or is this a BIG deal that impacts every single domain investor out there? I want to hear from you – comment and let your voice be heard!