Domain Michael wrote a great post last week titled, Brandable Domains vs. Lottery Tickets, if you haven’t read it yet you should, it’s a great post and absolutely on the money. I wanted to talk about this topic a bit more as I think this is something that every new Domainer needs to really think long and hard about.

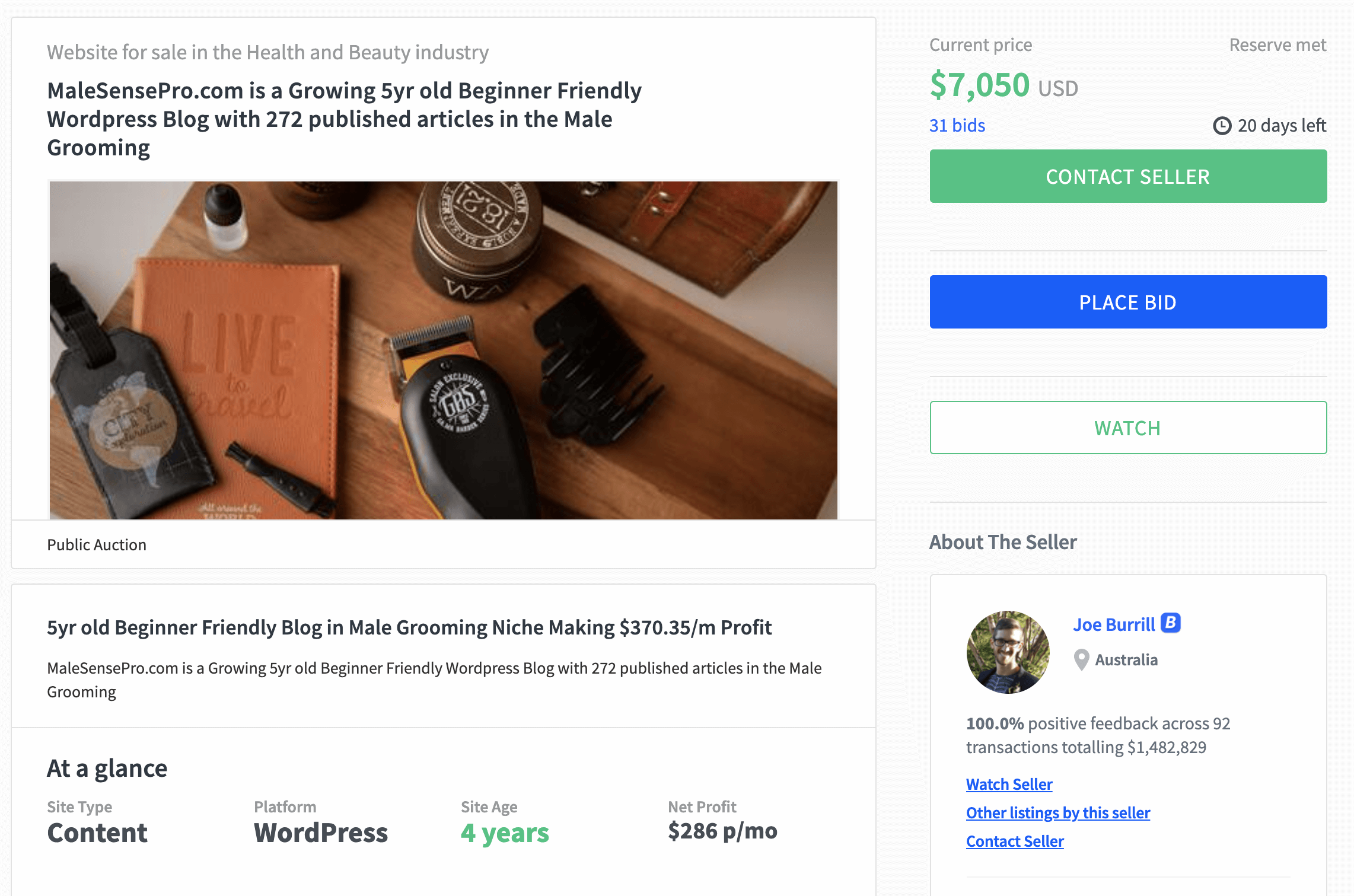

I get tons of emails every week from Domainers who are looking to sell their portfolios and cash-out. They have convinced themselves that after hand-registering hundreds of domains for years, they must be sitting on a pile of cash. The problem is, in many cases their not, and instead they’ve purchased some very expensive lottery tickets at $8 a pop.

First things first, I’ve been there. I spent five-figures building my initial portfolio and dropped close to $16,000 worth of domains in my first year – ouch! Yes, there was some pain there however it was also the best move I’ve ever made because I was being realistic with myself. I then proceeded to make more mistakes, however also made some pretty good moves along the way that more than covered my mistakes.

Still, it wasn’t until last year that I really started making meaningful money selling domain names. The development and monetization part I had figured-out in 2008 but it wasn’t until 2011 that I realized I still hadn’t figured it out when it came to buying and selling. What I learned was that I did have a lot of lottery tickets, domains that I had no track-record selling, and neither did any investors I knew, but I really believed that they were going to sell for big bucks.

I had a few very sobering conversations with two people I really look-up to in the space, David Castello and Braden Pollock and while I didn’t talk to them at the same time, they both made the same point. They couldn’t tell me if my random names that I thought would sell, would sell, maybe they could! What they could tell me is what’s worked for them. I went a step further and talked to people like Toby Clements and Andrew Rosner, and after getting advice from these guys I would have been stupid not to take it.

Once again, their advice wasn’t that all the domains I had wouldn’t sell, instead it was based on their own knowledge of what had worked for them and where they saw the liquidity. It was painful, I would once again have to drop some names, not the ones I had purchased for development, but the ones that I too had convinced myself would sell for big bucks. The message was incredibly clear, maximum liquidity is found with one and two-word .COMs.

Does this mean that three-word .COMs can’t sell? Of course not, there are lots of examples of three-word .COMs selling. Did this mean that .NETs and .ORGs sucked? Of course not, there are some stellar examples of great .NET and .ORG sales like one that Andrew did last April brokering AutoInsurance.org for a whopping $440,000. Still, that being said, if I was looking for maximum liquidity it was all about one and two-word .COMs.

So I made the move. I can still remember walking into Braden’s Office (we have lunch quite a bit since he’s close-by) and telling him of my new approach. His answer, “What the heck took you so long?”

Sometimes it can be hard to admit that you’ve made a mistake (or hundreds of mistakes) but the longer you spend ignoring it, or even worse, perpetuating it, the worse it gets. Now once again, to reiterate my point here, I am absolutely NOT talking about buying domains for development here – I’m talking about buying and selling names exclusively. Why I’m talking about this is because the emails I’m getting are people who want to sell their names and cash-in, not develop and monetize.

The question you have to ask yourself is if you’ve had a solid track-record selling domains like the ones you currently own, or if you bought your domains because you saw a few examples of similar names selling. These are two very different things. Just because AutoInsurance.org sold for $440,000 does not mean that all two-word .ORGs are worth six-figures, or even that more than 1% of them are – unless you have the experience yourself learning from the pros is the way to go.

So before you head over to my contact page and attempt a fire-sale of your portfolio, make sure you’re not holding a bunch of $8 lottery tickets. If you are, you’re going to need a lot, and chances are you don’t have thousands or tens of thousands of names. You’re trying to hit the lottery with 200 tickets and an investment of $1,600 or more. Be realistic and stop ignoring experts that are telling you what’s worked for them. It took me four years to make this breakthrough so don’t feel bad, but don’t keep buying names that you have no track-record selling, thinking that you’re building a valuable portfolio.

Remember, and investment is something that pays you. Take your time to learn, don’t feel bad, but make sure you’re making real investments at the end of the day, and if not, pivot and make a change!