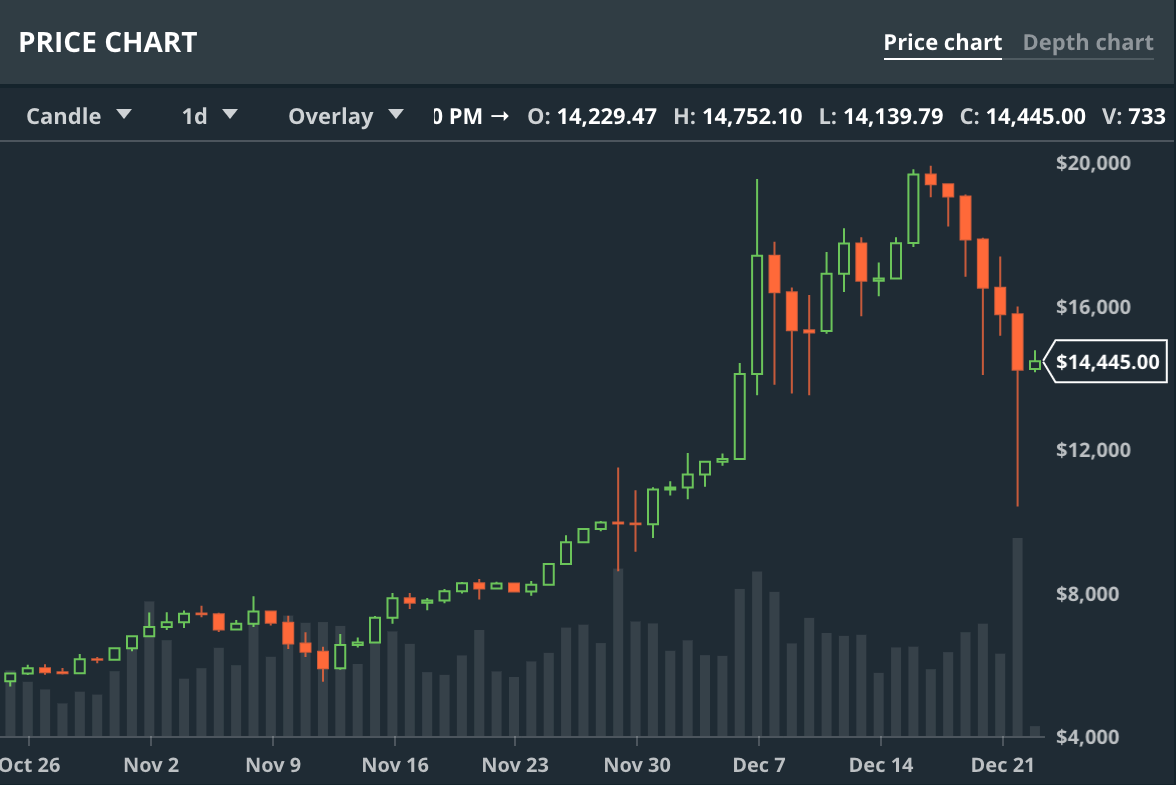

Today was an incredibly interesting day in the Cryptocurrency world as Bitcoin plunged in price, inspiring the hashtag #bitcoincrash. At it’s low the cryptocurrency fell 50% off it’s high of $20k dipping into the $10k range but quickly moving back up to the mid $14,000’s where it sits now.

Now it has been quite a while since I used Candlestick Analysis, but a long time ago in a galaxy far far away I did some Forex day trading and Candlestick Analysis was pretty essential to know when to enter and exit a trade. Now, more than ten years later I’m reading beginner tutorials to get back into the swing of things.

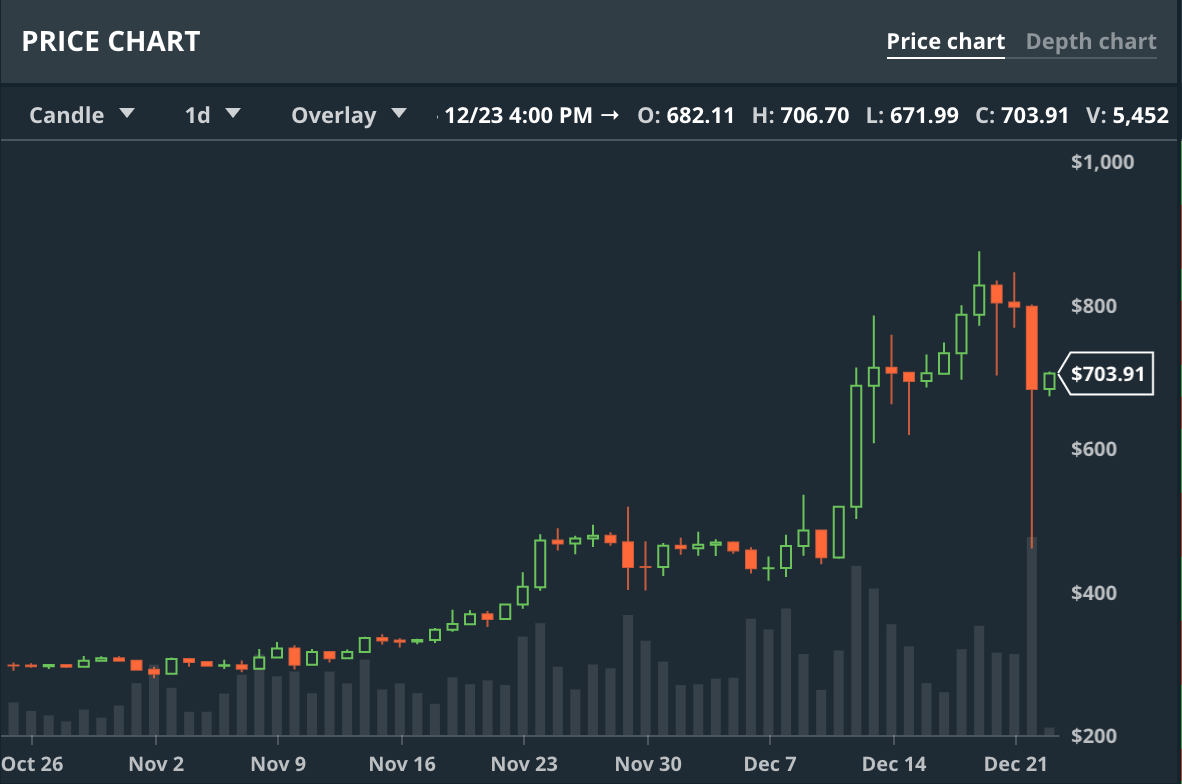

Oh, that’s just the long way of me saying that I can’t tell you too much about the chart below, maybe in a few months I’ll be able to go deeper. For now I can tell you that this daily chart tracking Bitcoin’s price since late Oct shows a pretty bearish pattern that started forming earlier this week:

What was also interesting to see is that most of the other major cryptocurrencies went down with Bitcoin, and just looking at Ether and Litecoin shows that these three actually exhibited pretty similar behavior when it comes to price movement. Here’s what Ether looked like and Litecoin looked almost exactly the same.

Now all the Litecoin I have at $43 so even though there was a nice dip, it still feels pricey to me. I’m in a similar boat with Ether with most of my ETH portfolio in the low three hundreds. So the thought of buying Litecoin in the high two hundreds and Ether in the seven hundreds honestly sounds crazy to me.

Of course that makes me think – well, I am in this for the long haul, and I still believe in Ethereum and Litecoin just as much (if not more) than I did when I first bought them, so why wouldn’t I but on the dips on their way up? That being said, given how volatile the crypto markets are right now, I think it’s hard for anyone to really know if this is just a dip on the way back to fresh new highs, or a roughly 30% discount across just about every major cryptocurrency.

So I’ve been going back and forth all day, and now and finally decided that I can’t decide. I read a bunch of different threads on Reddit (this is my favorite), looked on forums like Bitcoin Talk…and there are people on both sides but the general sentiment seems relatively positive, the seasoned Bitcoin investors feel like this is par for the course.

This made me think that now might be a good time to put more money into Ether and Litecoin and finally jump back in the Bitcoin game. But like I said above, I’m going to sleep tonight undecided.

Which is why I’d really like to hear from you – what do you think, is this just a quick dip before we move onto fresh new highs, or is this the beginning of a bigger crash? Comment and let your voice be heard!