When we moved to Austin everyone told us that this was one of the last accessible real estate markets in a major US city. After almost a year in the city I can tell you, those days are gone if you want to live in downtown Austin. Sure, you can live 30-45 minutes outside of town in a big house and still save big, but affordable downtown living has come to an end.

We moved to Austin from Los Angeles and I assumed that prices in LA were inflated, it turns out LA is actually significantly more affordable than Austin, even in incredibly desirable areas like Bel Air and Marina del Rey. Couple this with the fact that new luxury highrises are going up every few months and it looks like living downtown is only going to become more expensive. In short, there was a time to buy real estate in downtown Austin, and that time is long past.

According to a study done by RealtyTrac and published on MainStreet.com Austin is one of the five US housing markets that data shows is in a housing bubble.

“Property values have risen to Texas-sized levels in Travis County, which is home to Austin and some surrounding communities. Median prices there hit $374,900 in October, or 27.3% more than their February 2008 peak.” (Source – RealtyTrac)

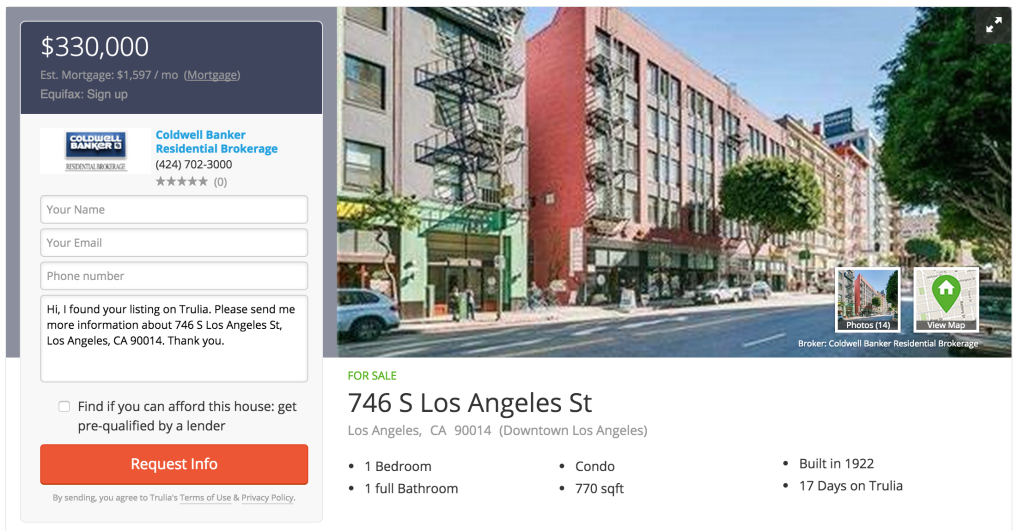

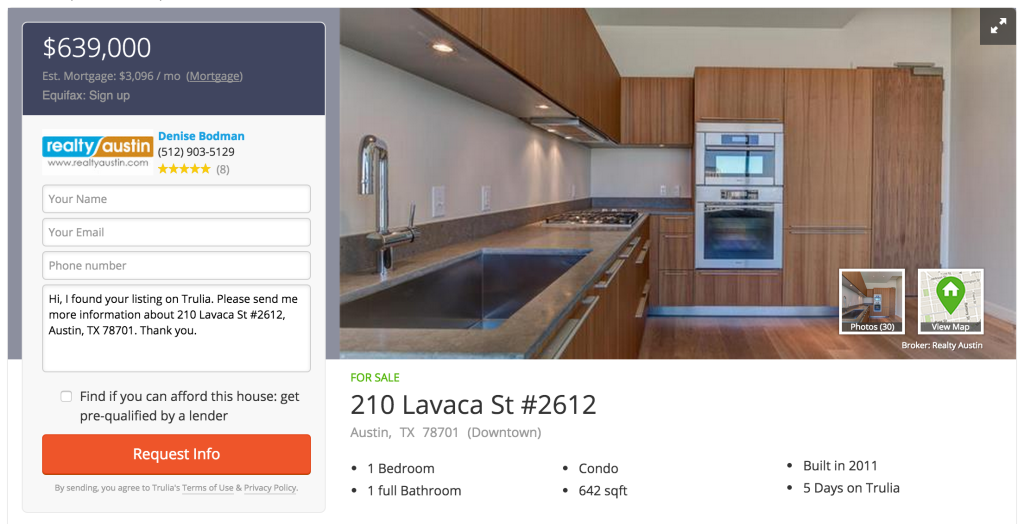

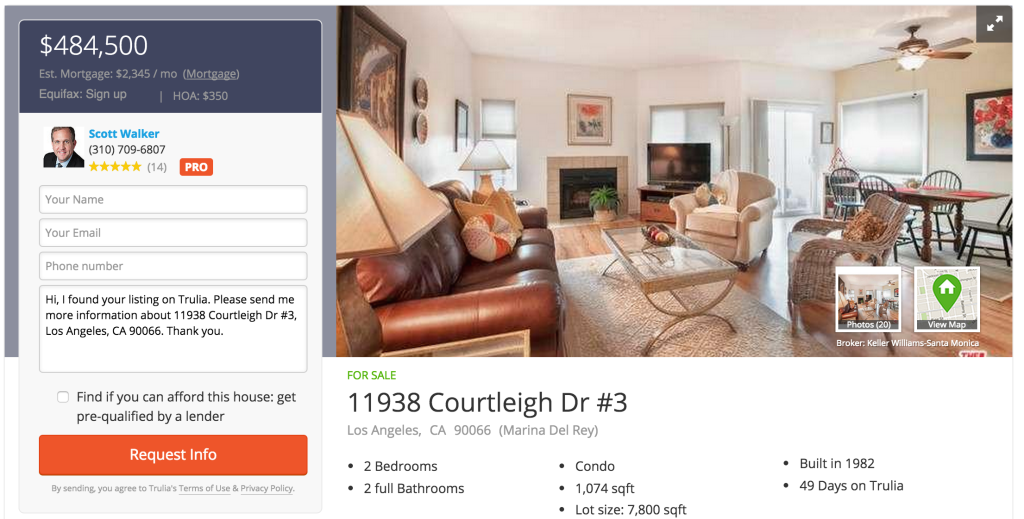

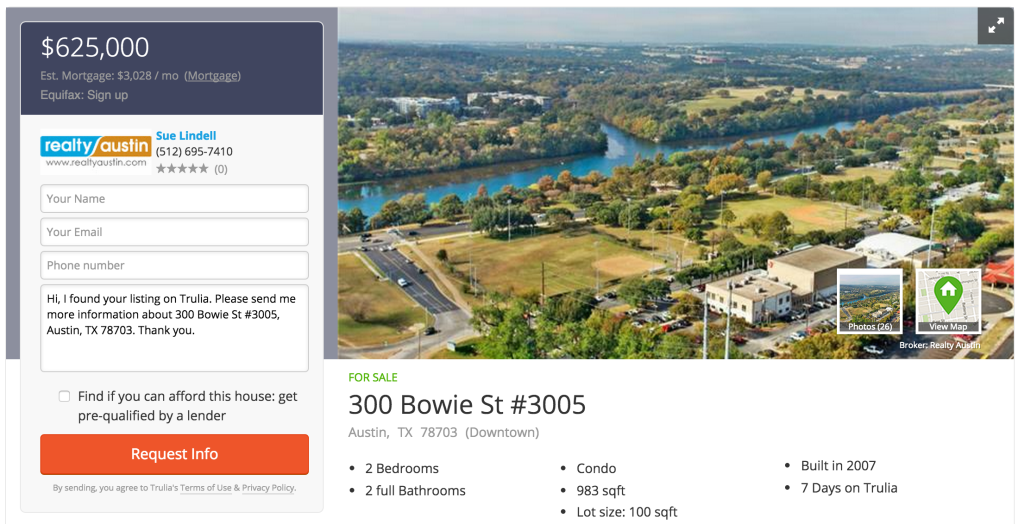

What’s funny is that property in downtown LA is actually priced at about half the cost of real estate in Downtown Austin. Couple this with the fact that property taxes in Austin are more than double the average property tax rate in Los Angeles and the market here looks even more unattractive. Here’s a look at a couple of properties in Los Angeles, both in very desirable areas, compared to two in downtown Austin. I’ve tried to find very similar properties to make the comparison as close as possible.

Downtown Los Angeles (770 sqft 1BR 1BA)

Downtown Austin (642 sqft 1BR 1BA)

Marina del Rey (1,074 sqft, 2BR 2BA)

Downtown Austin (983 sqft, 2BR 2BA)

—

Just to be clear, I’m talking about property in Los Angeles and Austin that are in desirable areas where people could easily walk to work. Without a doubt it is cheaper to live out in Hill Country in Austin where housing prices are definitely lower but when it comes to living downtown I think it’s safe to say we’re either in a bubble or Austin is on its way to becoming one of the most expensive places to live downtown.

I love it here, we moved from Los Angeles because I think Austin is without a doubt one of the most incredible cities on the planet. I’m proud to live here and call Austin home and one of the main reasons we moved is so we could walk to everything. I just wish we could get a two bedroom condo for under $500,000 like we could if we lived like the Fresh Price, in Bel Air.

Photo Credit: LindsayEvette via Compfight cc