Here’s the million dollar question, okay for most it’s the tens of thousand dollar question but let’s get a bit more dramatic to keep things exciting. It’s no secret that buyers in China were buying LLLL .com domain names last year at a stronger clip than ever before.

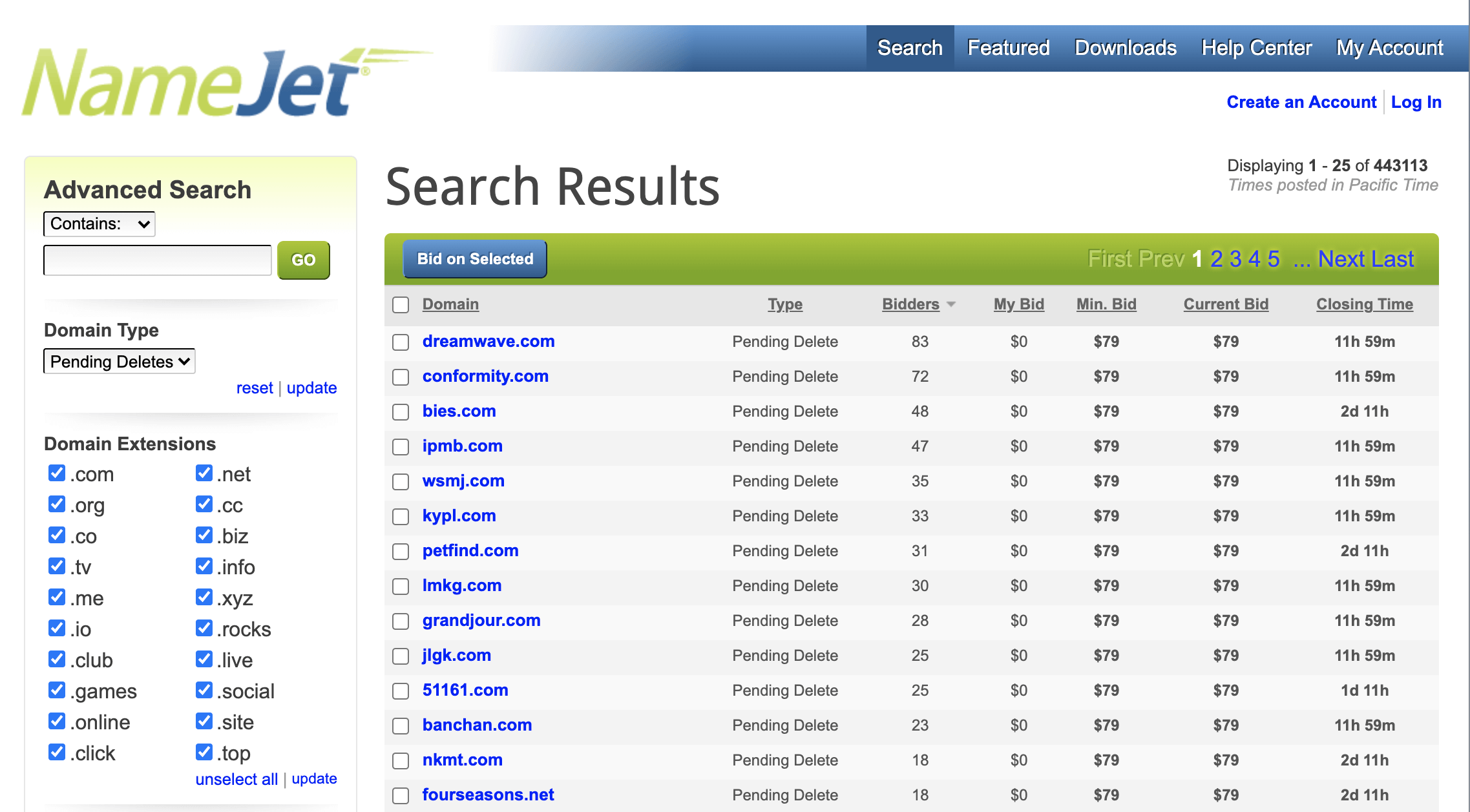

Then 2016 came and now there is speculation of a massive flood of LLLL .COM’s back into the market as Chinese investors dump these just as fast as they bought them.

I’ve never been a big LLLL.com investor, I’ve always liked words, and really like one and two-word .COMs. I have little skin in the LLLL .COM game outside of a handful of names, but I’m still in for north of $20k so I do care what happens, but either way I’m not predicting anything life-changing for me personally one way or another.

Still I’m scratching my head now and wondering, could 2016 be the year to buy LLLL .COM’s at a huge discount as fear spreads? Or is this the beginning of a major devaluation in what was just a few short months ago one of the hottest category of domain names out there.

What do you think? Is this the year to buy LLLL .COMs or is now time to get rid of them and replace with one and two-word .COM’s? I wish I had all the answers but I don’t – what do you think, comment and let your voice be heard!