One of my favorite people in the domain industry is Alan Dunn. Alan has been in the industry a long time and along with investing and brokering domains he’s also written about the topic quite a bit as well.

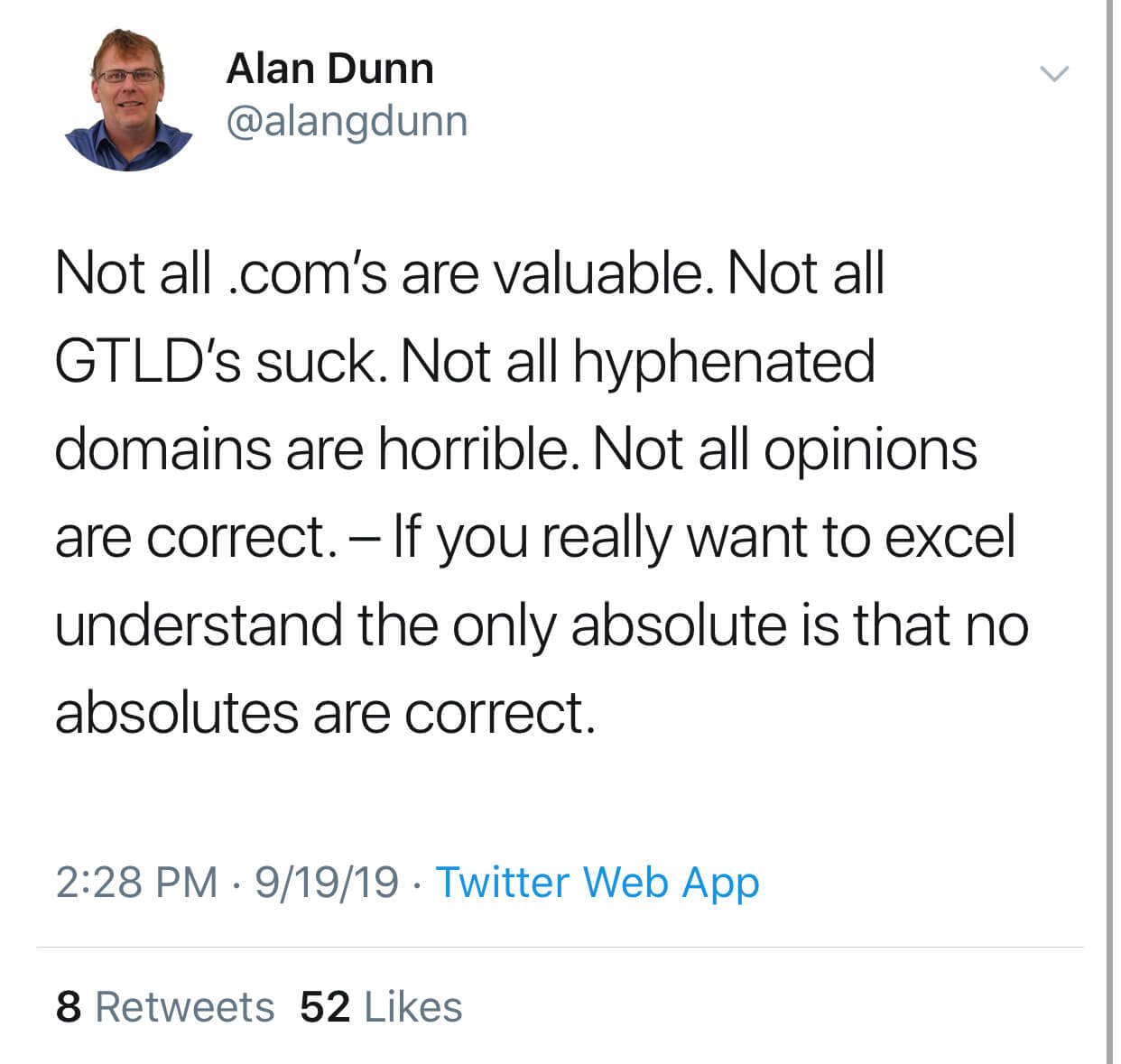

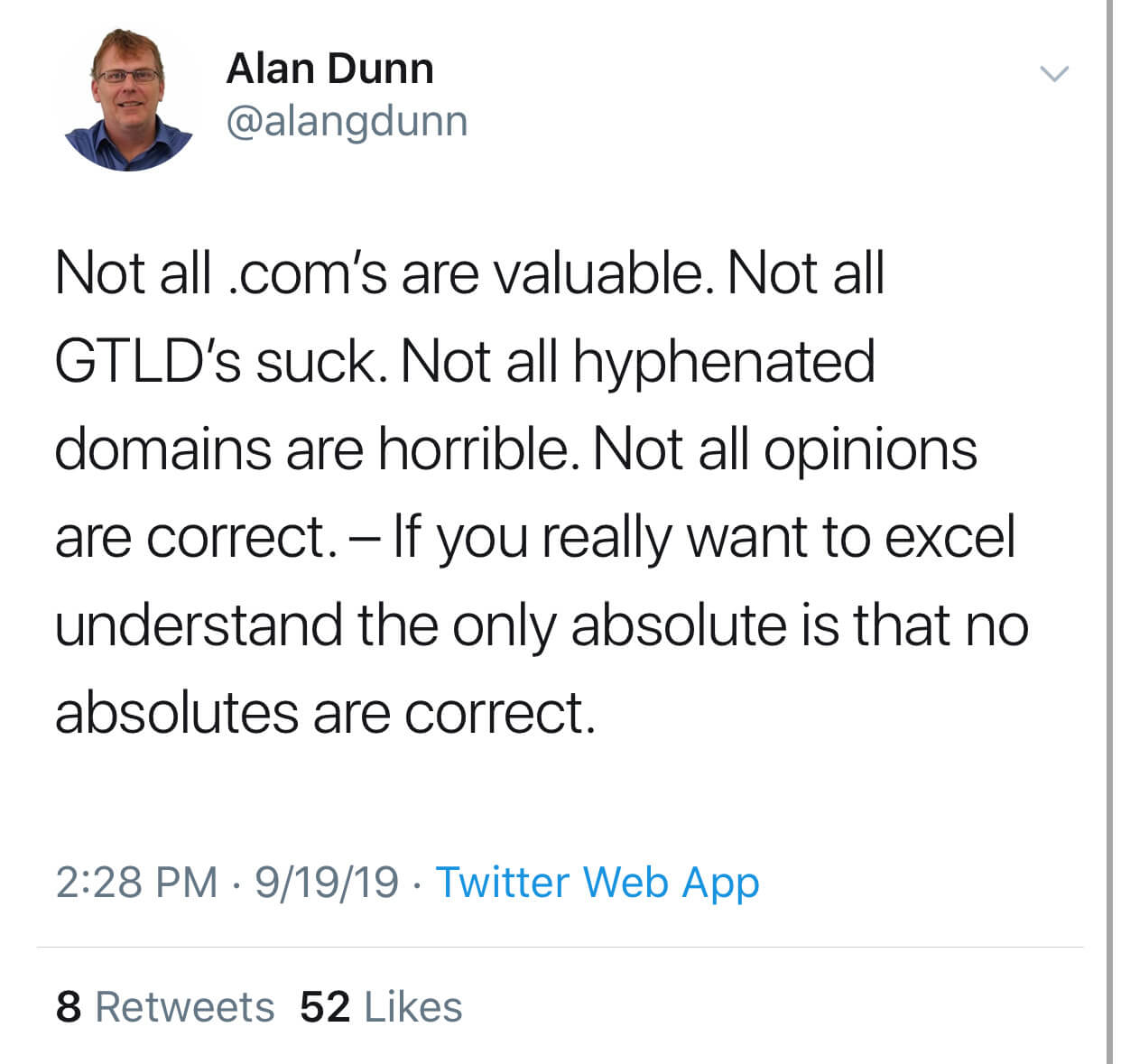

What I like about Alan is that he’s not afraid to speak his mind and tell it like it is, and this tweet from him last Friday was one of my all-time favorites:

Now I’ve said it many times before and I’ll say it again – I personally don’t invest in new gTLDs, my focus is .COM. At the same time, I always find it a bit crazy when people talk in absolutes and say that nobody can make money with new gTLDs or that anything but .COM is a complete waste of money.

The reality is, we all take different paths, and yes, there’s no argument that .COM is the most proven path, but there’s also no argument that a LOT of people are sitting on portfolios of .COM junk. Domain Investor Logan Flatt said it best in his response to Alan’s tweet:

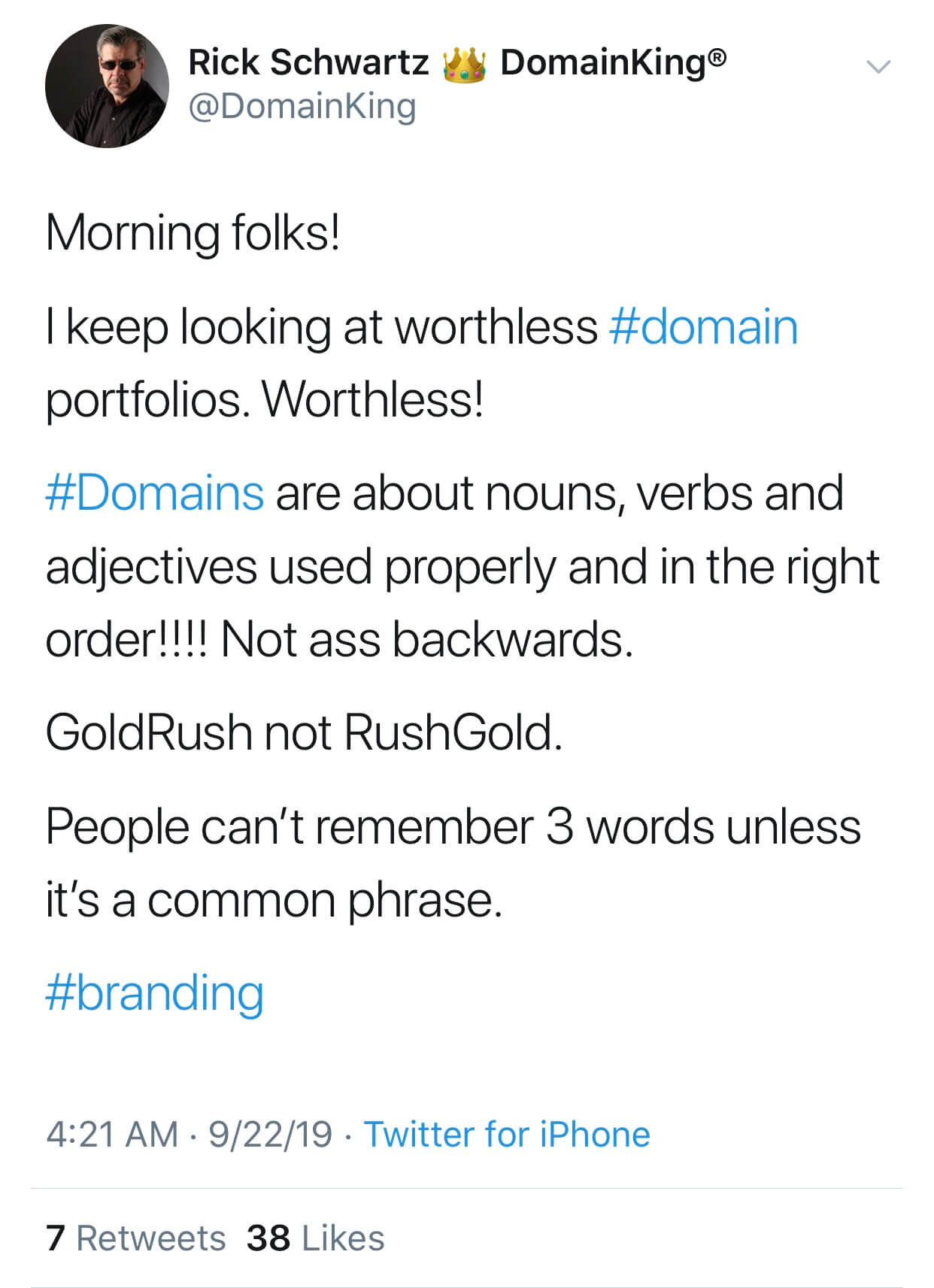

This week Rick Schwartz also echoed this point and expressed his frustrations with people buying junk in a tweet yesterday:

The reality is, you can buy only .COM and still end up with a bunch of garbage, like the example Rick gave above, Goldrush(dot)com is a great domain, RushGold(dot)com is garbage.

The point Alan makes is a good one and I’m glad he said it because it really needs to be said. There are no absolutes in this world and when it comes to domain names there are opportunities everywhere. Heck, Rick is putting his videos on Rick.tv, he sees the value of .TV for branding here as do I. Now would I go invest in a bunch of .TV names, nope…but brand on it when the content is video, sure.

It’s time for all of us to realize that while I think we can all agree .COM is king, that doesn’t mean all .COMs are good investments. At the same time, while we all agree buying nothing but new gTLDs would probably be a mistake, this doesn’t mean any new gTLD investment is. Let’s be okay having conversations about how we’re growing and evolving as an industry and that means moving away from absolutes and starting to talk more about opportunities, what’s working, and what isn’t.

What do you think? I want to hear from you, comment and let your voice be heard!