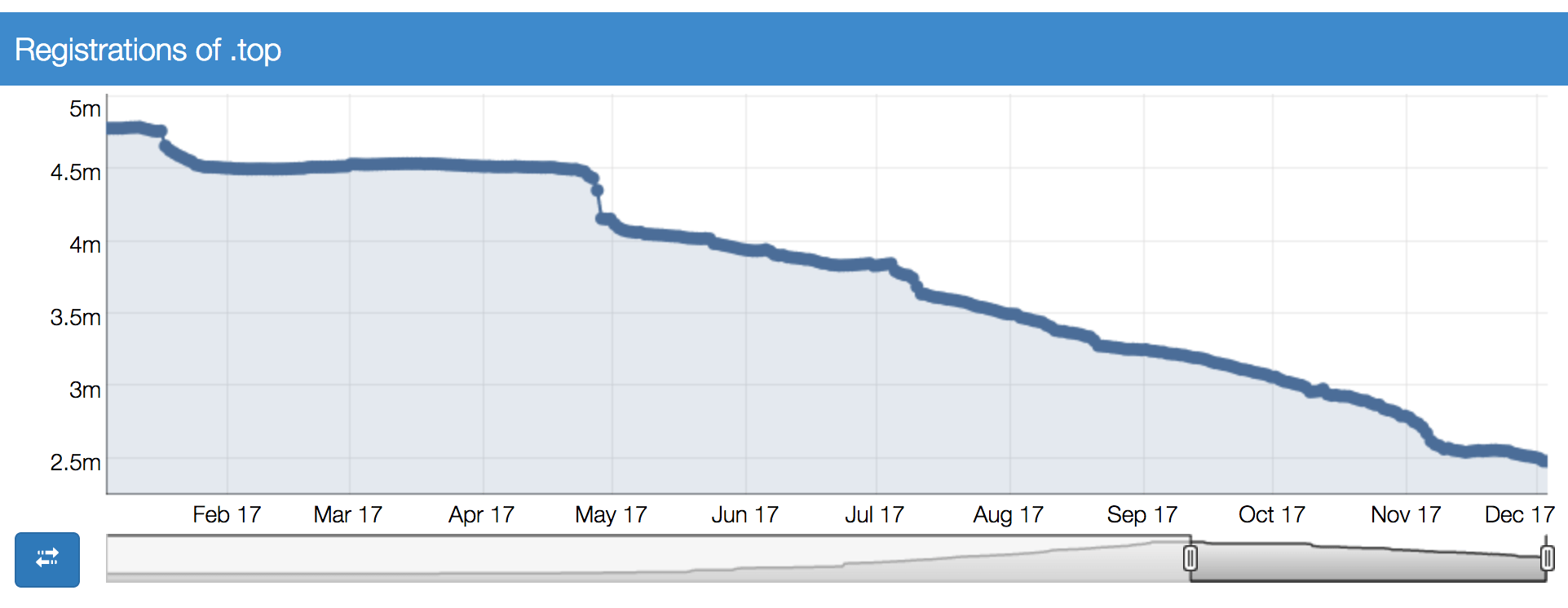

.TOP has been the #1 new gTLD for a while this year, and even now they sit at the #2 spot when it comes to registrations…but their one-year chart tells a different story:

Ouch. This doesn’t look like a chart that would make you think this is one of the top new gTLDs. Think about it, if a stock, cryptocurrency, or piece of real estate had a one year chart that looked like this you definitely wouldn’t jump to put your money into it.

So why then are new gTLDs so interested in touting registration numbers? Isn’t registration growth, i.e. a chart that goes up and to the right the real metric of success?

The challenge is, consumers don’t really know any metric other than registrations. Instead they hear marketing campaigns that brag about registration numbers and think, well if that’s one of the most-registered new gTLDs, it must be hot. If they just took a second to look at the registrations over the course of the year, they’d see the reality.

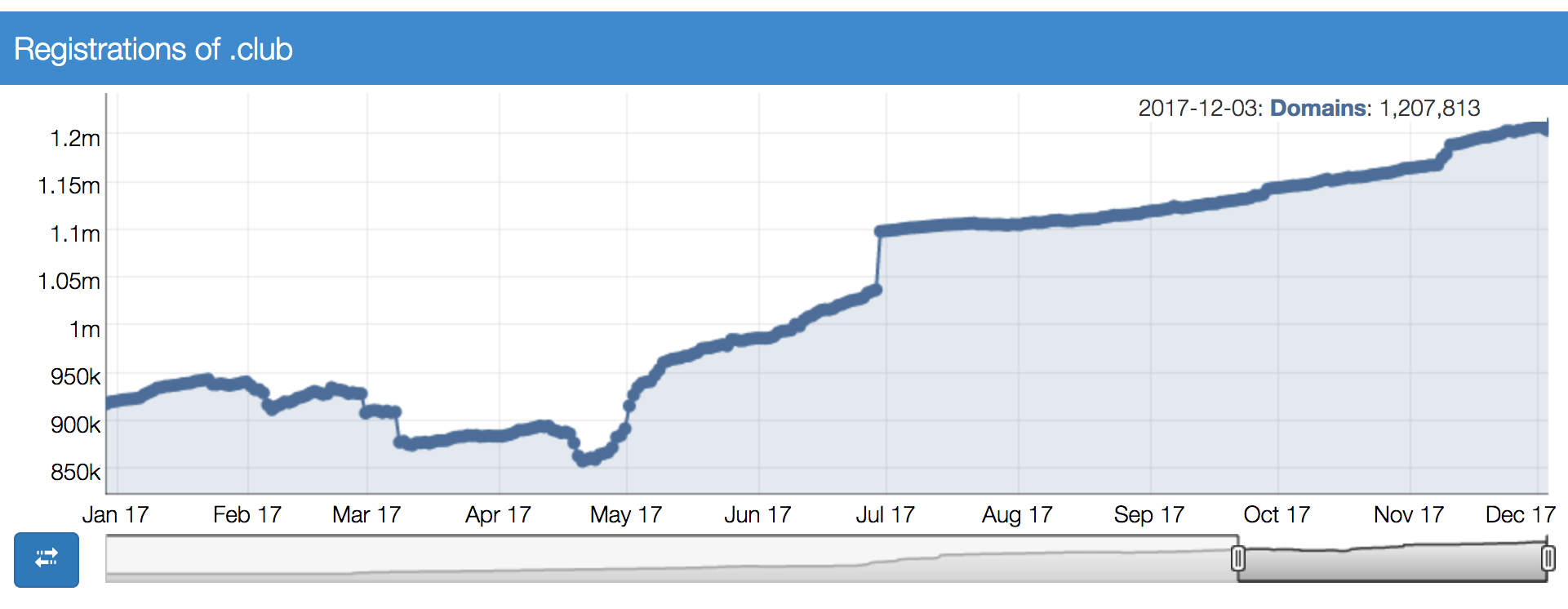

The chart for .CLUB is a much better example of a new gTLD that sits in a top spot, and is growing:

So while .TOP started 2017 with close to 5M registrations, and with 2.4M still sits in the #2 spot, it literally lost half of its registrations over the course of the year. While .CLUB technically sits in the #4 spot, two below .TOP and with half the total number of registrations, they’ve seen steady growth over the course of the year.

Domain names are such a new asset class that most people don’t know how to look at them yet. Compare this to stocks and it’s a completely different story. What do you do when someone recommends a stock to you? Usually you look at the chart for the last few months, then for the year, and that is critical data when it comes to deciding whether to invest or not. Nobody would make an investment by just looking at the price of a stock, so why would they decide to invest or brand around a new domain extension just because of the sheet number of registrations?

Still, these are the very early days for new gTLDs and domain name investing in general, still I’m ready to start spreading the word and getting people who are interested in investing in domain names to pay attention to the metrics that matter…not the vanity metrics.

What do you think? Comment and let your voice be heard!