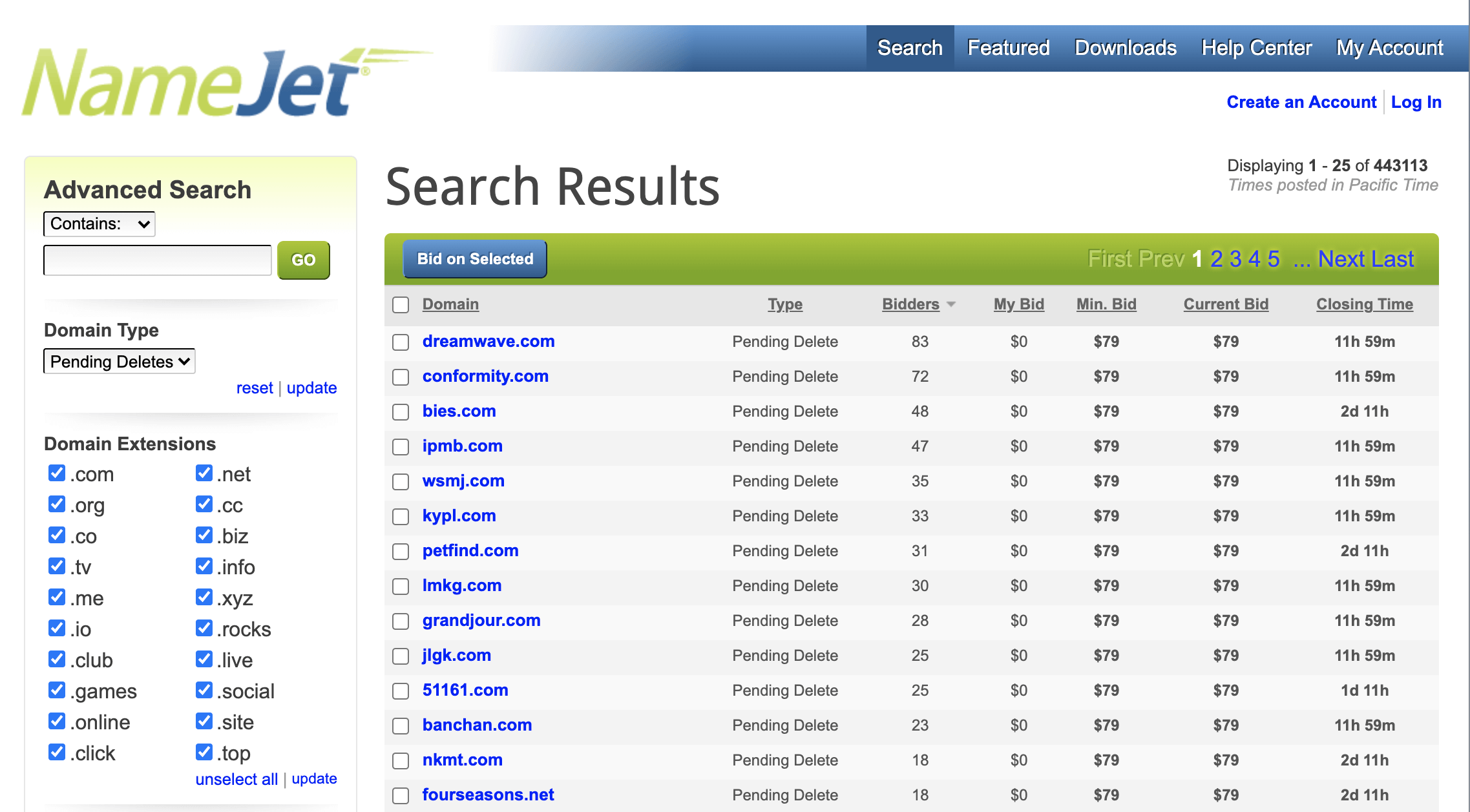

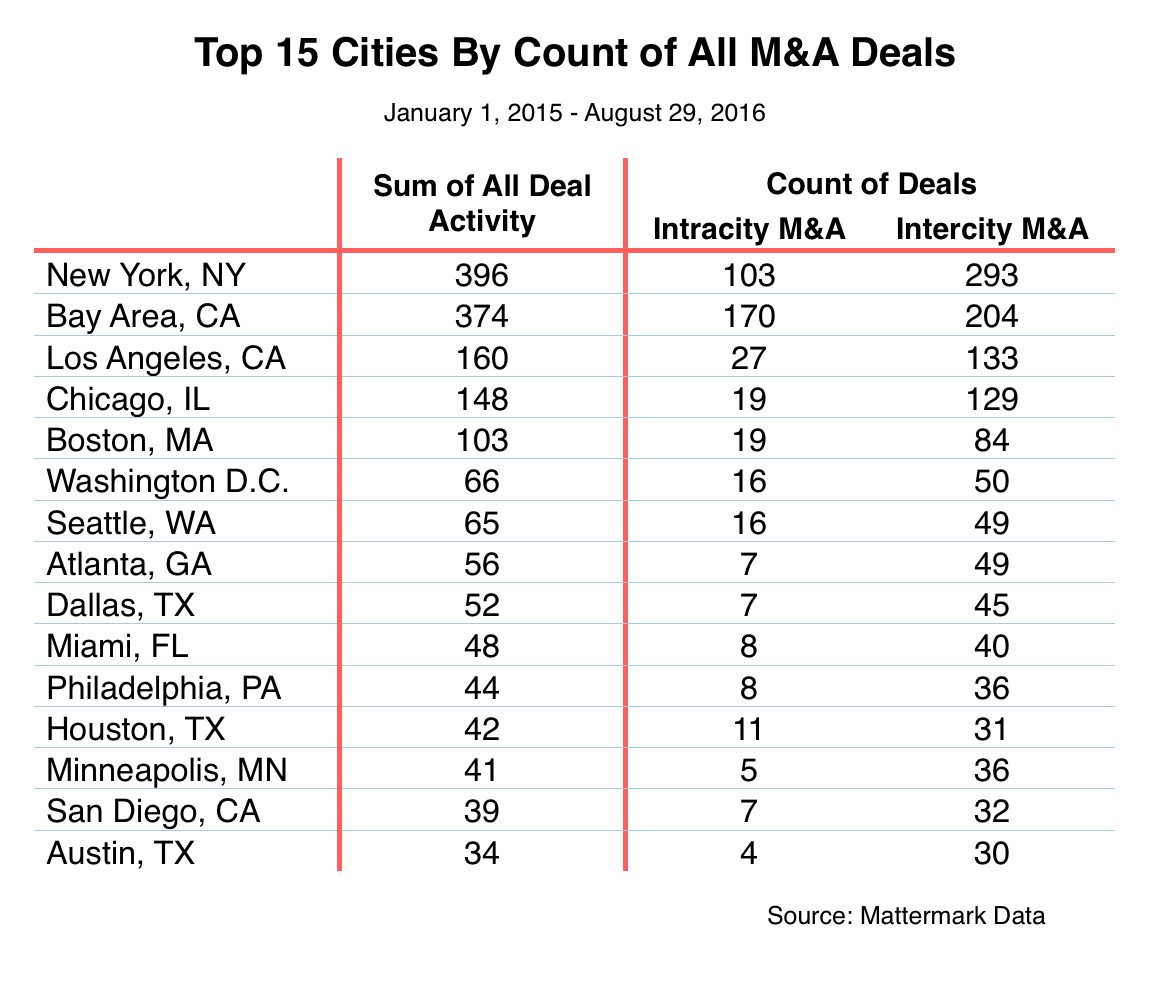

In a report released by Mattermark last week New York City edged out Silicon Valley in M&A activity with early-stage companies dominating in concentration. Not surprisingly most M&A activity tended to gravitate towards regional hubs, which makes sense since that’s where most of the acquiring companies are located:

Leading regional hubs exchange companies with one another quite freely, whereas companies from smaller cities flow more readily to their leading regional hub. (i.e. west coast startups flow to the Bay Area, and Midwestern startups flow to Chicago.) (Source – Mattermark)

While I’d love to say that our now hometown of Austin is a top ten, at least it made the top 15 when it comes to M&A activity. Of course this doesn’t mean that Austin companies don’t get acquired, but when they do the acquiring company is more likely to be in New York, Silicon Valley or LA. Here’s the full rundown of the top 15 cities for M&A activity in the US:

How does your city stack up when it comes to M&A? Did you make the top 15?