Last week I asked my readers if they would be interested in a weekly post about the stock market. I’ve been investing in stocks for over twenty years and while I don’t put that much time in, and I’m far from a guru (like really far), it’s something I’m interested in and have enough money invested in to keep it interesting.

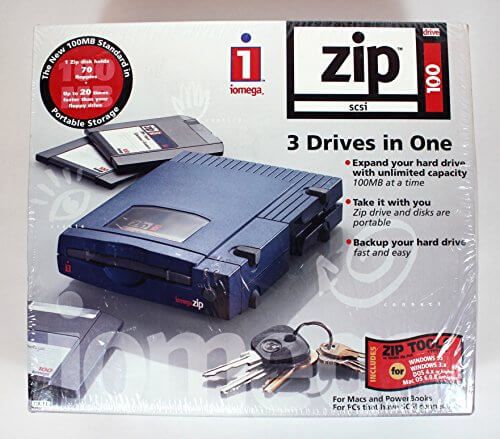

As for how I originally got into the stock market, I give my Dad credit for that. When I was maybe thirteen years old he told me I could pick one stock and he would put $1,000 into it. At that time I was totally into Apple computers and all the new gadgets I could connect to my computer. I thought this little company called iomega was doing something pretty revolutionary with the Zip Drive, remember this thing?

To me the Zip Drive was all the rage, mostly because it allowed me and my friends to share video games way easier than ever before. My Dad had never heard of it but said if I wanted to spend the $1,000 on an unknown stock, I could.

My guess is that he expected the stock to tank, who the heck had even heard of this tiny company, iomega? For those of you who don’t remember what happened to iomega, here’s a fun little recap:

IOmega isn’t usually one of the names investors associate with the Dot Com bubble of the late 1990s, but the stock was one of the first dramatic examples of the impact that dramatic internet-fueled buying enthusiasm could have on the market.

At the time, iOmega produced Zip disk drives that offered a major upgrade in portable data storage capacity. The first Zip drives held 100 MB of data compared to a maximum capacity of only 1.44 MB for floppy disks at the time.

In one year’s time, iOmega stock skyrocketed more than 2,000 percent, driven by investors hyping the stock on online bulletin boards and in chat rooms. Unfortunately, the iOmega bubble soon burst, and the stock had plummeted 68.1 percent by May 22, 1997.

IOmega was eventually acquired by EMC Corporation in 2008.(Source – Yahoo Finance)

I would have to go back and ask my Dad what our actual profit was on it but I think I remember turning that $1,000 into something in the $10,000 range. This early experience really inspired me to take investing more seriously. I continued to invest in the stock market with my own money (I started a web design company shortly after – I’ll save that for another post!) and haven’t stopped. What’s slowed me down when it comes to investing in stocks is domain names which is where I’ve been focused for the last thirteen years.

Still, I can’t help but think, if I never invested in iomega and had that great experience, would the “investing bug” have passed me by? Maybe I would have never invested in stocks again, maybe this whole domain investing concept would have never crossed my mind.

Either way, it’s safe to say at the age of 13ish, I got the investing bug, and it has fundamentally changed my life in many ways. While I don’t have an insane amount of money invested in the stock market, I do have six-figures invested so it’s enough to certainly keep things interesting.

Next week I’ll share some of my favorite investments and then I think it’s only fair to start sharing what stocks I’ve bought/am buying, and what price I’m buying them at so we can share the ups, and the downs, together.

One thing to know about me is that I’m not a day trader, when I buy a stock I’m looking at it over a long time period. Typically I think – do I think/have data that strongly suggests this stock will be worth a lot more in 10-20 years. Any money I put in the stock market I don’t plan to touch for a long time. I’ll continue to mention this as I know it’s likely different for everyone, and I know that some people invest money that they need that year or the following year in which case our strategies might diverge quite a bit.

That’s it for now, it was fun writing this post and…fun fact, while you’re reading this I’m actually backpacking with a good buddy out in the middle of the Carson-Iceberg Wilderness, you know – this place:

I’m writing this post on Wednesday, August 5th and scheduled it to post on Saturday. So hello from the wilderness, thanks for reading, and stay-tuned for another Stock Market Saturday next week!