Many of you know Sahar, he is a domain investing legend and actually the guy responsible for getting me involved in the domain industry, not intentionally, but through his blog. It was back in the summer of 2007 that I literally stumbled on Sahar’s blog and said, “holy shit, people are making money with domain names?”

Yes, I was late to the game but I learned one lesson very quickly, it was all too easy to count single hits as successes without looking at the big picture.

Sahar posted some words of wisdom on Facebook yesterday about a topic that I think very clearly represents the #1 business mistake Domain Investors can make:

Why so many domainers who sell domains tend to look at the ROI as if the sold domain is the only domain in their portfolio? Those other domains you hold for all these years and other junk you will never sell are an integral part of the equation.I see this happen all the time and while this topic is often absolutely fundamental to a business, many domain investors can easily gloss over it because Domaining isn’t their full time thing, they have steady income coming in from a day job and thus they can ignore this and focus on the home runs.

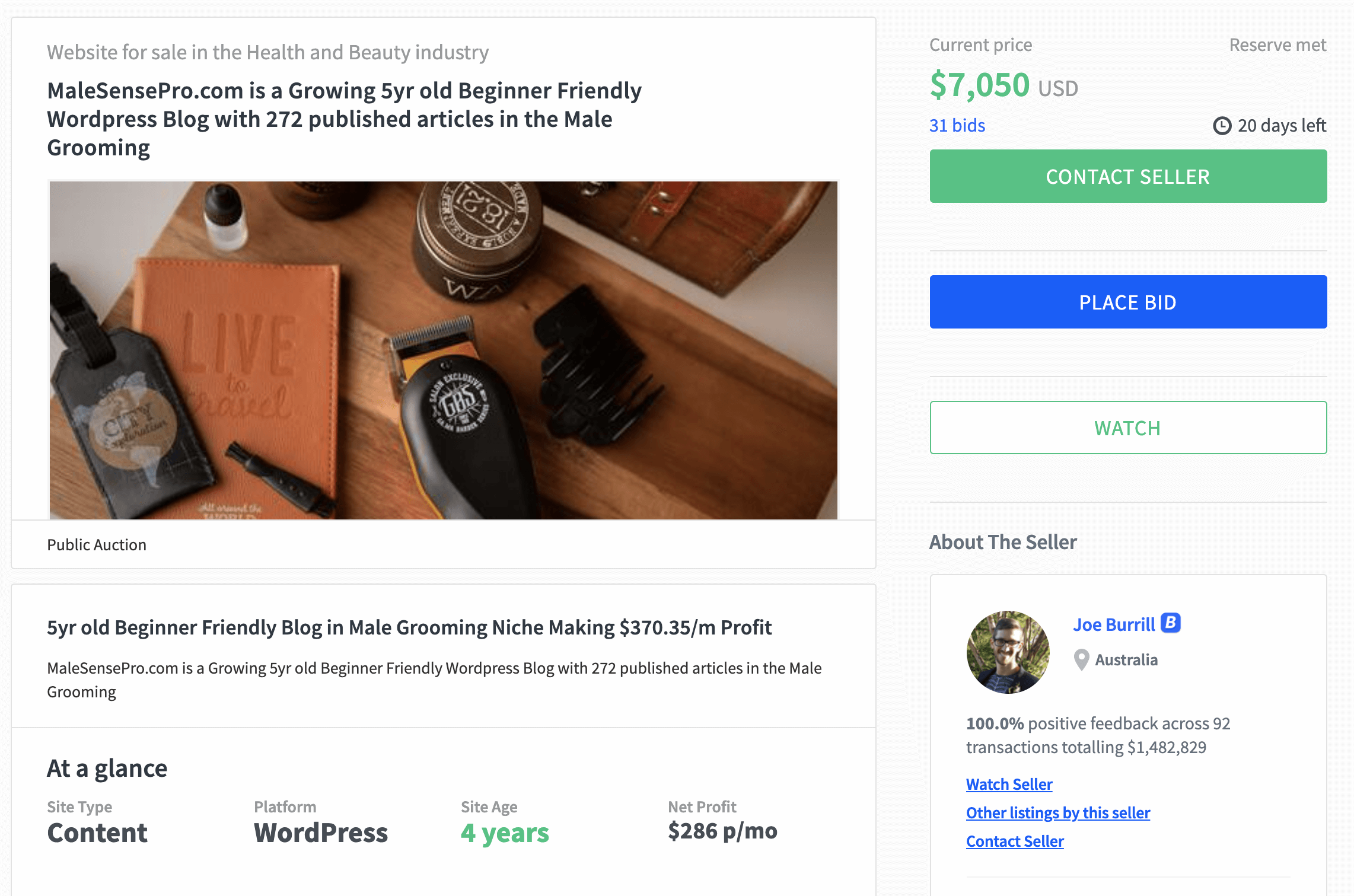

Here’s the harsh reality that I learned back in 2008 and you should definitely know by now, or if not, learn today. If you’ve spent $50,000 total on domain names and just sold a domain you bought for $50 for $5,000 that doesn’t mean you’re a successful Domainer. You have to look at the bigger picture.

Now if you’ve already made $60,000 on the $50,000 you spent then you can celebrate this 100x profit and do the happy dance. However if you’ve only made $20,000 so far, then you’re only at $25,000 which means that up until this point you’ve just found-out how to lose half the money you put into this hobby.

Yes, if you’re losing money it’s really not a business, it’s a hobby, and that’s how the IRS looks at it as well. I can’t tell you how many times at conferences I talk to someone who is telling me about all their recent sales and then I ask the simple question, “so is your business profitable?”

They look at me with a blank stare and typically say something like. “Well I have a bunch of other names I’m sure will sell and then it will be very profitable.” Great, then do it.

If domain investing doesn’t represent your primary income source it can be easy to get lost in the sauce and focus on your individual sales rather than the big picture – your business (or hobby).

Of course there are plenty of Domain Investors who know this, run a real business and carefully track their profit. The key is to not look at individual sales but instead take yourself up to 30,000 feet and ask yourself, did that sale make my business profitable or am I still trying to recoup the money I put-into this?

I learned this lesson the hard way in 2008 what I thought I was “killing it” with domains only to find-out I was spending more than I was making. Never again, I course corrected and have been running profitably ever since. So be honest with yourself because at the end of the day there are a lot of domain hobbyists out there that think they’re running a domain business, make sure you’re not one of them.

Photo Credit: Dave Dugdale via Compfight cc