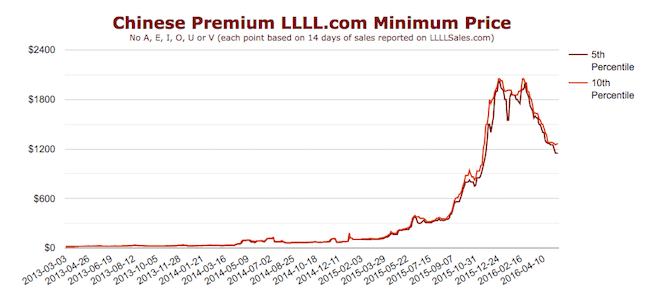

One of the hottest topics in the domain name world so far this year has been the decline in sales prices for 4L .COMs compared to the spike in Q4 2015. The average price of a 4L .COM (Chinese Premium) has declined from a high of just over $2,000 in December of 2015 down to around $1,300 now.

(Source – LLLLSales.com)

Last week a bit of controversy around 4L .COMs broke out on Michael Gilmore’s blog. Michael then responded to the negative comment with a blog post which I think is great to see. It can be easy to try to hide criticism but facing it head-on and responding to it is, in my mind, a clear example of how to take the high road in the situation.

“I published an article about ChiP (Chinese Premium) domains yesterday and received a really interesting comment from a reader that I would like to unpack. For a start I would like to thank them for the effort they took in writing the comment as it’s clear they are really passionate about domains.” (Whizzbangsblog)

The comment Michael is referring to is from a blog reader who didn’t agree with Michael on where the market is going, i.e. hold onto your CHIPs vs. selling them.

“Your advice to sell is terrible advice. And then you offer to help CHIP owners liquidate. Four-letter .com prices are positioned to move up substantially in the coming years and you recommend getting out now. You obviously needed a better translator on your China trip. SELLING CHIPS NOW AT LIQUIDATION PRICES IS TERRIBLE ADVICE. PLEASE DON’T HEED.”

Michael shared his perspective on his blog and I think he shares some great insight into what’s going on with 4L .COMs and the Chinese market. Of course these are only opinions, none of us really know what is going to happen. For myself 4L .COMs represent less than 5% of my portfolio so I feel comfortable sticking with them for the long haul. If 25% of my portfolio was CHIPs, I might look at things differently.

I do agree with Michael that at the end of the day it’s all about your risk profile and what you can do to grow your money the most effectively. It’s no secret that the market dynamics are changing rapidly in China, the truth is none of us know where this is all going to land five years from now.

What do you think? Are you holding onto your 4L .COMs or is it time to liquidate and re-invest? Comment and let your voice be heard!