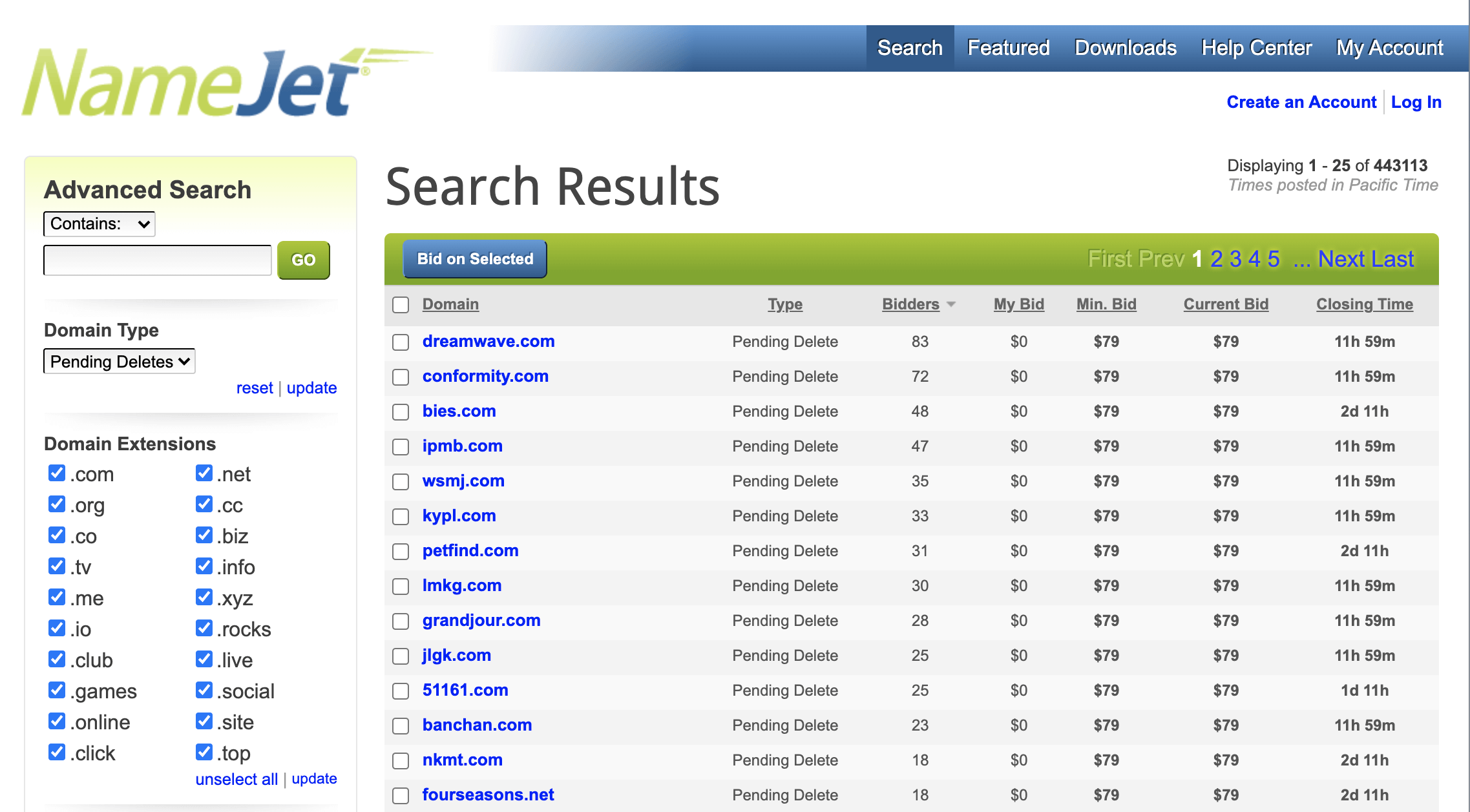

One thing I’ve gotten in the habit of doing over the years is looking at the top 20 expired .COM names on Go Daddy auctions, NameJet, and other domain auctions sites. Without reserve pricing and all buyers knowing that the domain will sell to the highest bidder, auctions like this give incredible insight into the market, and what the market value is for names in popular categories. Here’s a glimpse into the domain market in December, 2015:

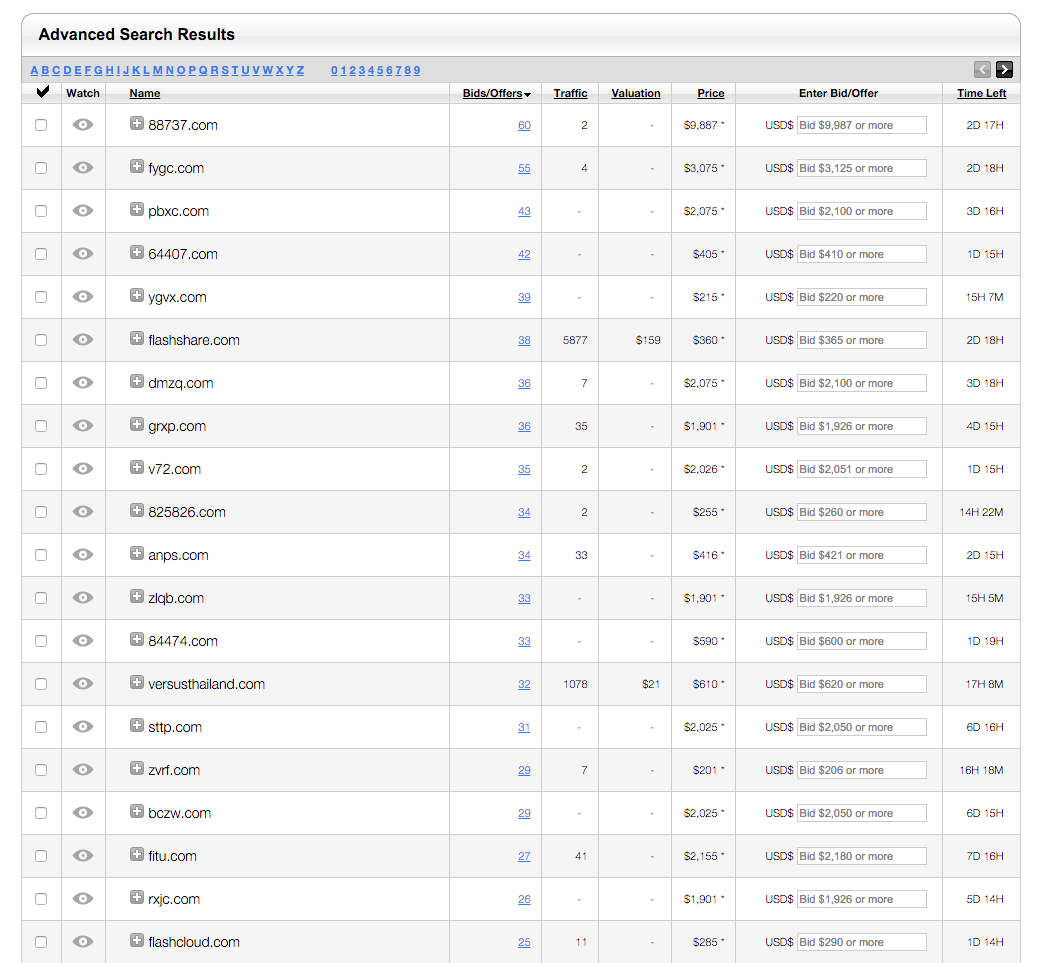

Notice anything? Well there’s 5N .com’s going for over $9,000 and lots of activity on four character names like FYGC.com and PBXC.com, domains that would often get far less attention and command much lower prices. There are only three two-word .COMs in the top twenty which shows how this market has softened with investors. Notice that I said investors because if you’re bidding on an expired domain auction site you’re probably bidding against other Domainers. Sure, there are definitely some business owners that look at expired domains for their business but most of the time that’s not the case.

While this is boring review for experience domain investors (you can skip this post!) – to those starting-out this is a nugget I think you can’t live without. What you should appreciate about this is that you’re seeing real data showing what investors will pay for specific types of domain names, and what types of domain names are hot with investors right now. These prices can also help you determine the fully liquid value of your portfolio if you have names like you see in the list above.

You have no excuse though when it comes to missing a trend, or over-inflating the value of your domains, the data is there. Just remember, these are investor prices, selling to an end-user is a whole different ballgame. It’s a change, and these changes aren’t slowing down. Rewind a year or two and this list was filled with keyword rich domains like FlashCloud.com.

Fast-forward five years from now and I think you’re going to see incredible activity in the domain aftermarket as consumers around the world get comfortable with new gTLDs.Next time you look at your portfolio and say, “that name is definitely worth $10,000” – just ask yourself if you’re really looking at liquid, “sell it today” prices, or dreamy end-user prices? Data like what I have listed above will keep you realistic with your expectations and hopefully in the end, help you make better investments in domain names that have real liquidity and generate meaningful returns.