Last week I wrote an article about potential renewed interest in .US domains after Zoom’s meteoric success while branding on one. I’m not personally putting an investment focus on the space, for me I see .COM as my primary focus for many years to come…but that doesn’t mean I haven’t been taking a look to see what’s going on over in .US land.

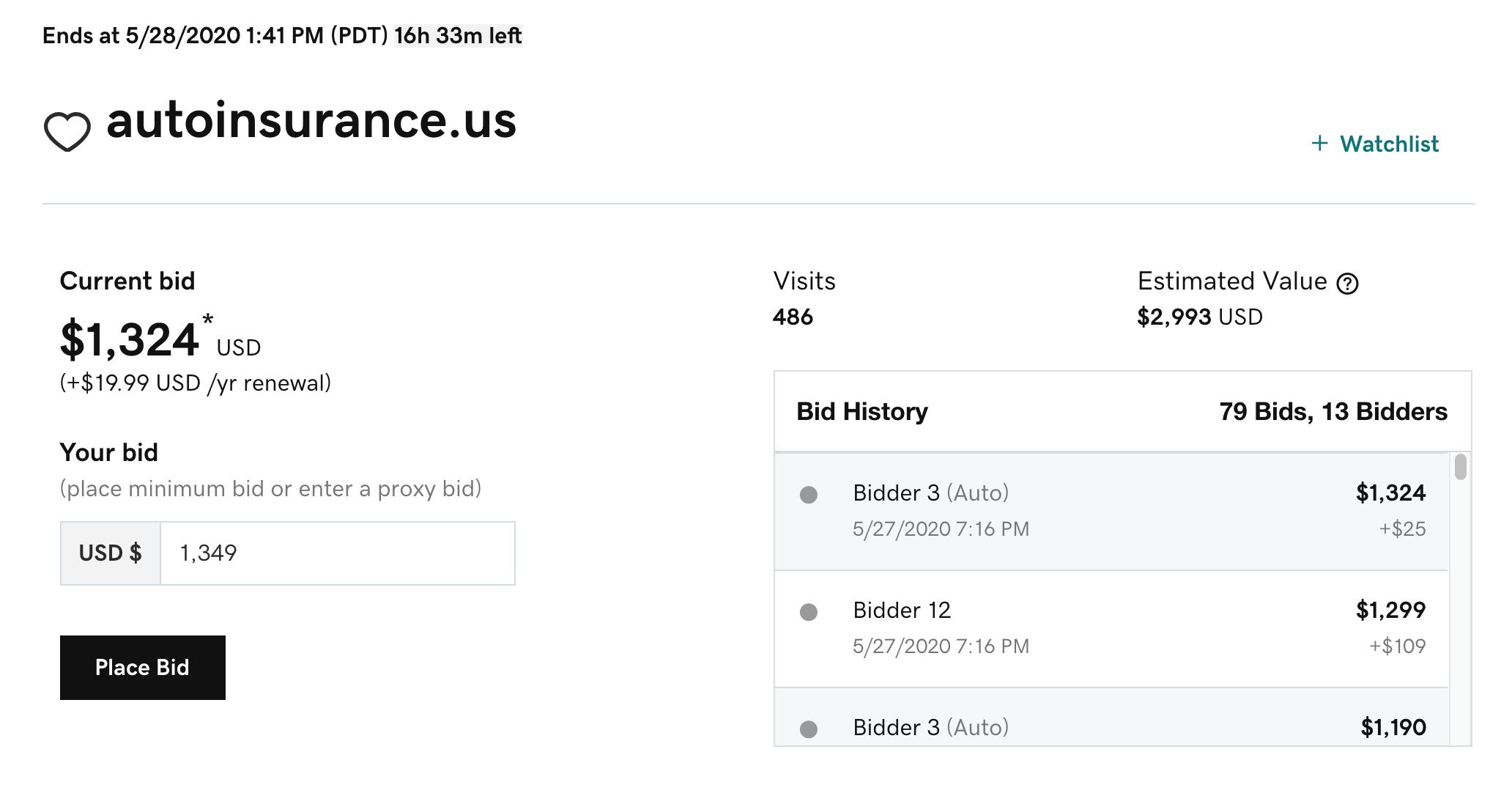

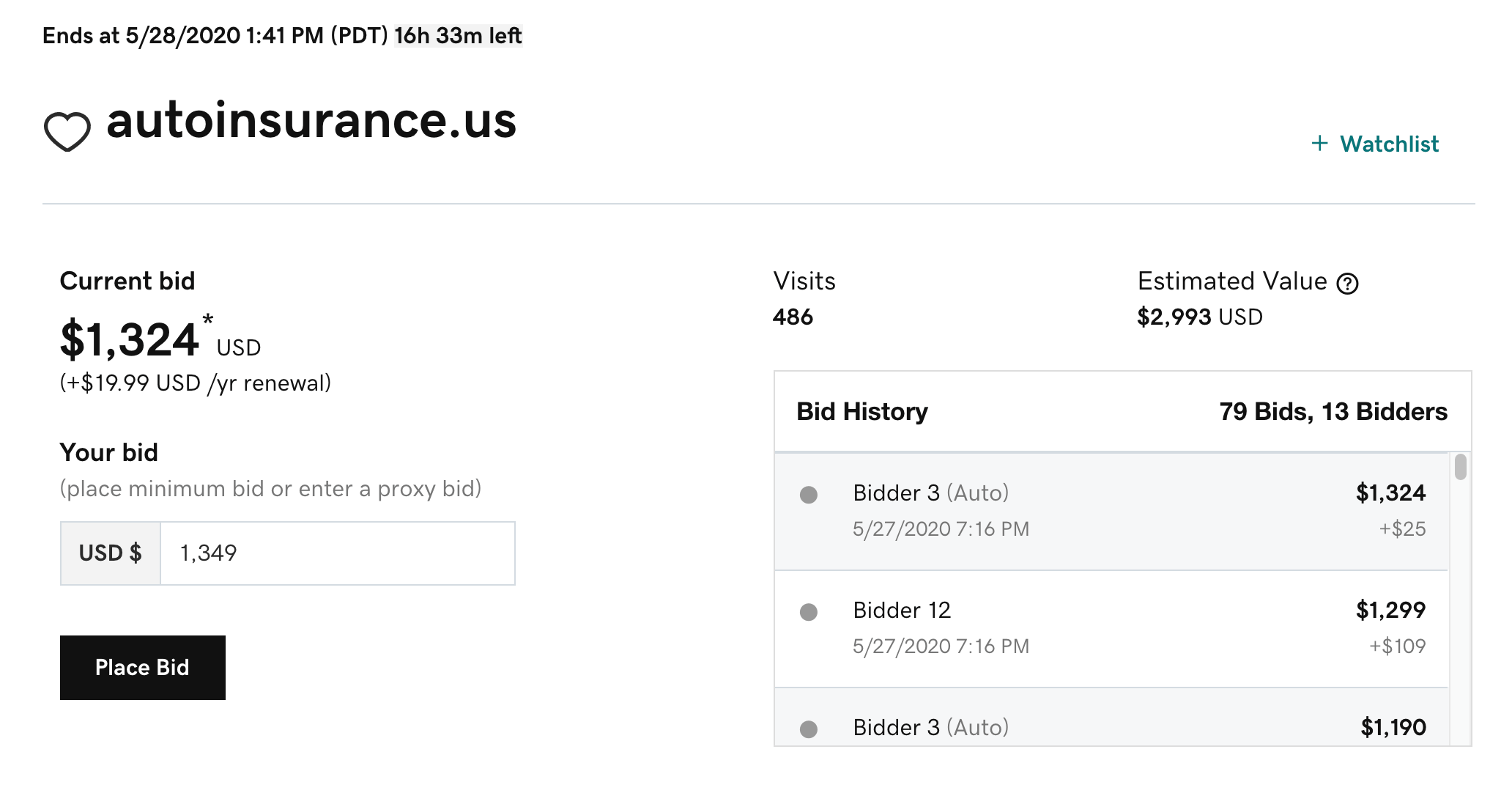

So I was pretty surprised to see when I was poking around Go Daddy Auctions tonight that AutoInsurance.us is at $1,324 with 16 hours to go. Given that there are 13 bidders in this auction it wouldn’t be too surprising to see this name sell for over $2,000.

I’m not sure how many end-users are shopping for expired .US names on Go Daddy auctions so I’m assuming this is a domain investor, but maybe I’m totally wrong there, you tell me. If this is an investor, then they likely think they can get quite a bit for this domain.

While we all know that the insurance space is a big money maker for lead generation companies online this does seem like a lot to pay for a .US domain. Of course, like I said, I’m a .COM guy so I don’t know much about the .US market, maybe you know something I don’t.

What do you think? Is this just a normal auction price and wholesale on this name is in the $2,000 range or is an end-user in the auction driving the price up?