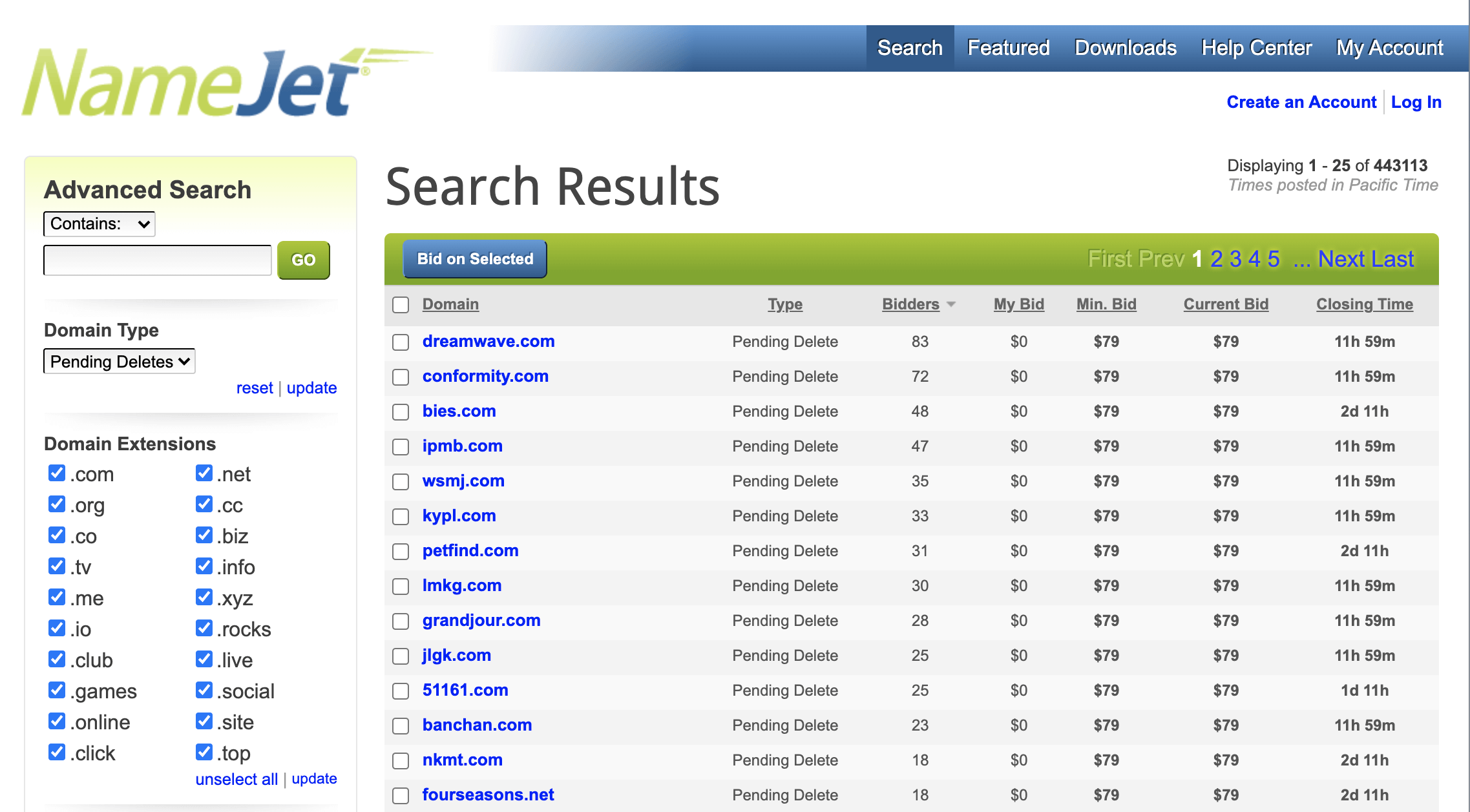

I’ve said it before and I’ll say it again – the majority of my investments are and will continue to be .COM. I think I’ve repeated this almost weekly for the past year but still people seem to miss the boat because they know I’m also a fan of new gTLDs. How can this be? Easy, you can invest in .COM and still believe that new gTLDs will ALSO be good investments.

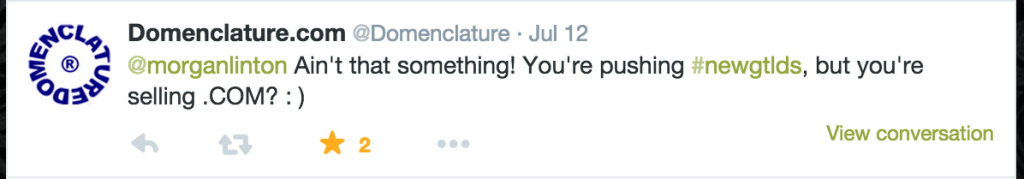

Over the weekend I announced a domain sale of mine and got the following response on Twitter:

It seems that there’s always confusion when I talk about how I see potential in new gTLDs so I thought I’d make my stance clear so as not to accidentally mislead anyone.

I still put the vast majority of my investment dollars into .COM, and .COM domains continue to be the TLD I focus on when it comes to buying and selling domain names. At the same time, I think that new gTLDs have incredible potential and I am proudly investing in these and happily selling non .COMs at the same time.

I would absolutely not suggest that anyone drop all their .COM domains and focus on new gTLDs. At the same time, I think not investing in new gTLDs will mean missing out on some great investment opportunities later down the road. I think five years from now still over 50% of my investments will be .COM, but I also think I’ll have more new gTLDs than I have today, and I’m also confident I’ll have some awesome new gTLD sales under my belt.

So expect to see me writing more about new gTLDs, it’s the beginning of something great and I’m behind them 100%. Just know that you can be a fan of new gTLDs and a fan of .COM. I’m not alone here, Frank Schilling, Michael Berkens and many other domain investors that are much more badass than me also see the opportunity, but like me they are also big fans of .COM at the same time.

What do you think? Do we have to pick sides or is it okay to believe that .COM is the best investment today but that new gTLDs could be great investments as well in the future? Comment and let your voice be heard!