Primary Venture Partners released a report today on the state of the Seed Stage investment market in NYC for Q2 and the results show a noticeable slowdown in funding activity. According to the report, Q2 2016 was more than 40% below Q2 2015 in both dollars and deals.

Now this all should be taken with a grain of salt since Q2 2015 was a monster quarter for NYC funding activity and yes, activity can slow down for a few months without the sky falling. Still it’s data that is important to founders, and really important to keep an eye on.

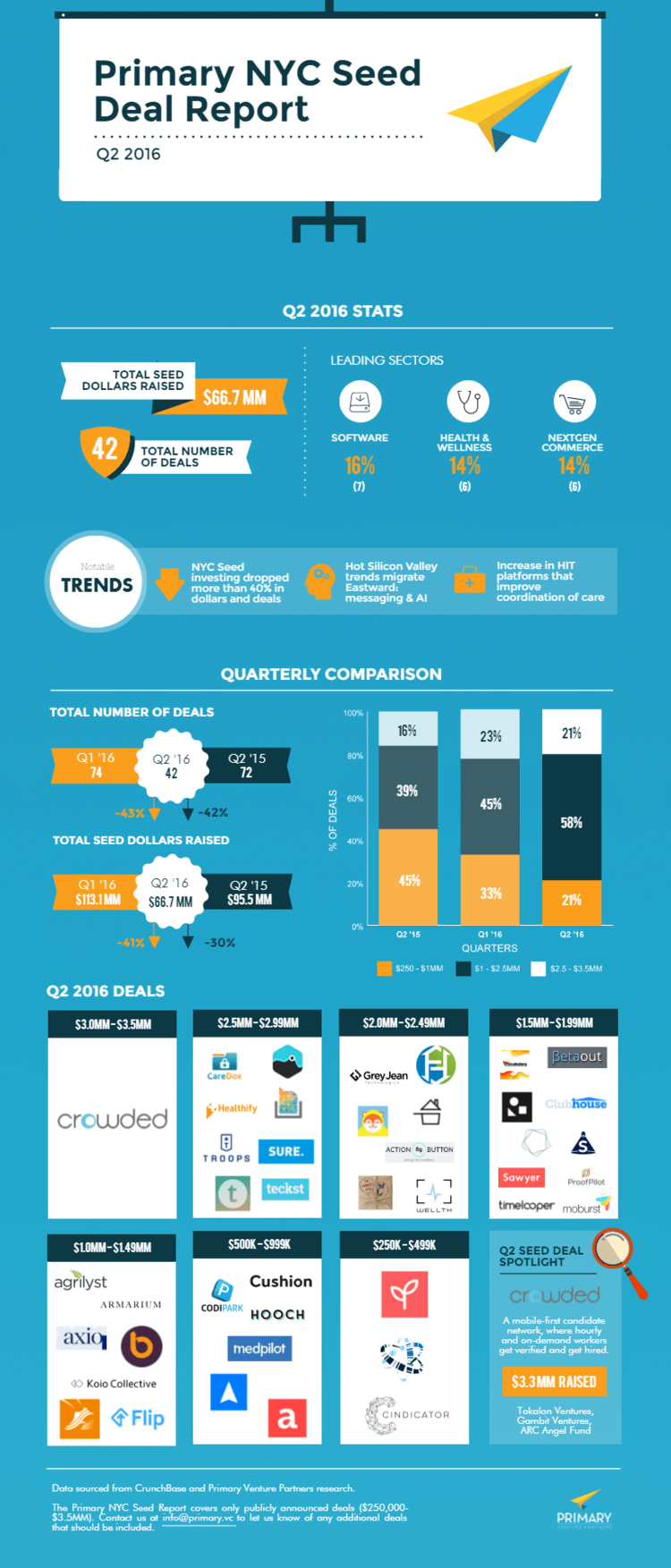

Here’s a handy infographic that gives a deeper look-into the VC funding that took place in NYC over the last quarter: