For those who know me, you know that I read the Wall Street Journal every day, have for years – moved from the paper version to the digital version a few years ago. I’m possibly one of the only people who reads the Journal and watches Cheddar eSports news updates every day, but hey – that’s me!

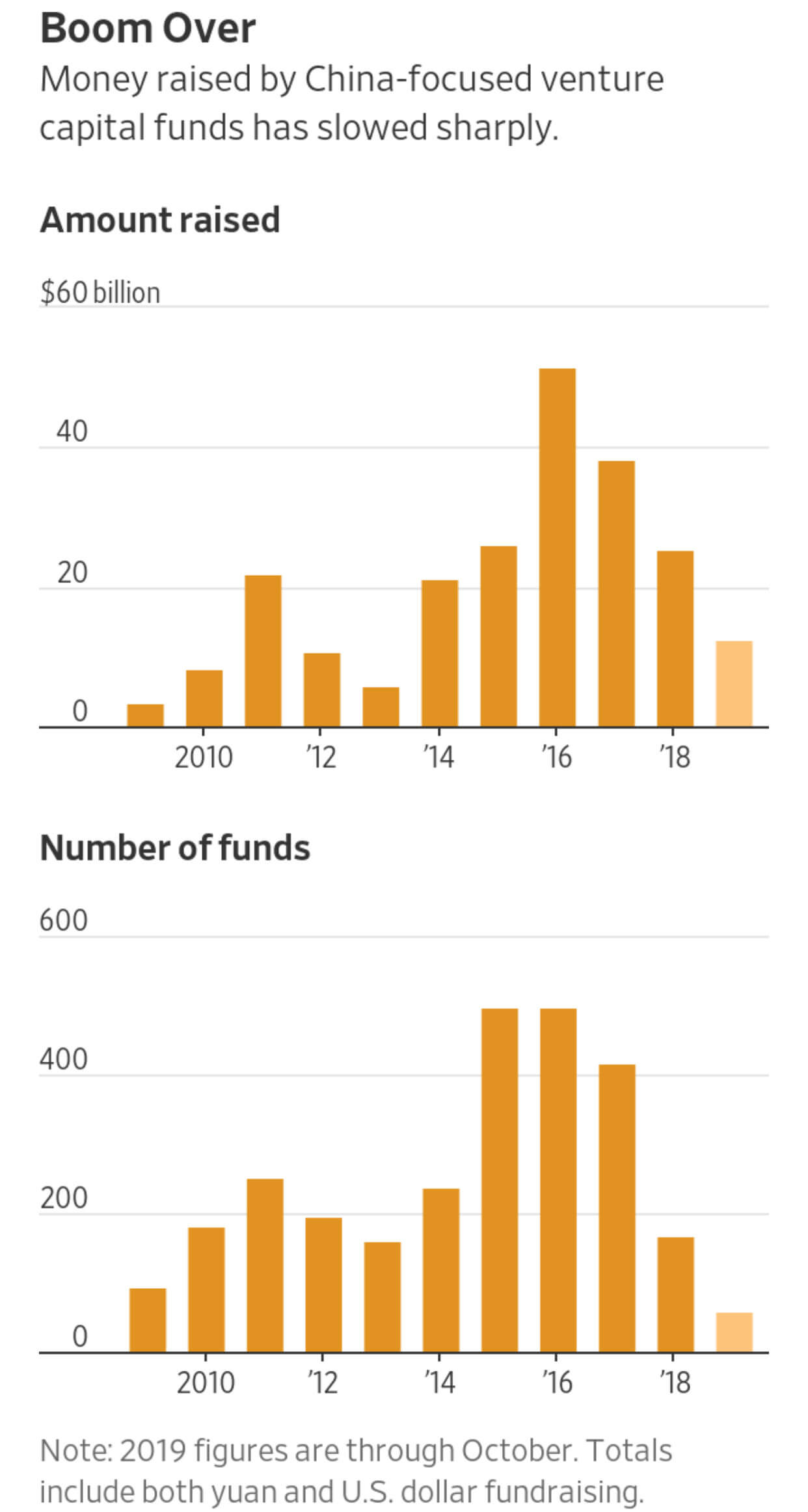

Okay – now back to the topic of this post, the decline of Venture Capital activity in Japan. Today there was an interesting article in the Journal about the end of China’s Venture Capital Boom. In it, they shared some interesting data on the decline in both number of funds and money raised by funds in China, here’s a high-level look at the numbers:

The article goes on to talk about how VC firms in China didn’t turn out to be the golden ticket to riches so many people had hoped they would be. As a result, the startup ecosystem is shrinking, funding is declining, and well, talk of China becoming the next Silicon Valley has been put on hold.

Of course, as a domain investor this got me thinking. If people who were looking to get a higher than normal return are moving their money out of startups in China, this could mean domain names could come back in style.

For anyone who has been following the domain market in China you know that it peaked a few years ago and then dropped, and well, it hasn’t ever recovered. I’m wondering if 2020 could be the year we see a shift as funds move away from startups and venture capital in China and into alternative assets.

What do you think? Am I onto something here or am I way off? I want to hear from you, comment and let your voice be heard!